Trepp: CMBS Delinquency Rate Increases Again in July

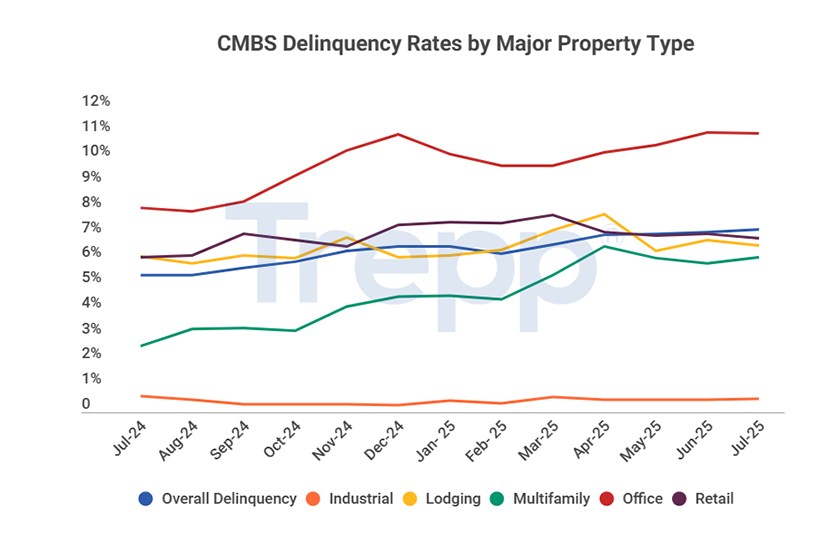

Trepp, New York, announced the CMBS Delinquency Rate rose for the fifth straight month in July, up 10 basis points to 7.23%.

Year-over-year the overall delinquency rate is up 180 basis points.

The overall delinquent balance was $43.3 billion, up from $42.3 billion in June. And, the outstanding balance was $598.9 billion, up from $593.4 billion.

The volume of newly delinquent loans was above $4.4 billion in July, outpacing the volume of loans to cure, which was $3 billion. Mixed-use, retail and office all had more than $800 million of loans turn newly delinquent in July.

If Trepp included loans beyond their maturity date but current on interest, the delinquency rate would be 9.36%, up 65 basis points from June.

In the 30-days delinquent bucket, the percentage of loans is 0.3%, up 2 basis points from June.

The percentage of loans that are seriously delinquent–defined as 60-plus days delinquent, in foreclosure, REO or non-performing balloons, is 6.93%, up 8 basis points.

If defeased loans were removed, the overall headline delinquency rate would be 7.41%, up 9 basis points from June.

The multifamily rate rose 24 basis points to 6.15%. Lodging was near flat, up only 1 basis point to 0.52%.

The lodging rate fell 22 basis points to 6.59% and the retail rate fell 16 basis points to 6.9%.

The office rate, at an all-time high of 11.08% in June, fell 4 basis points to 11.04%.

The CMBS 2.0+ delinquency rate rose 9 basis points to 7.11%.