Cotality Says Slower Home Price Growth Could Open Doors for More Buyers

(Stock Photo Credit Blake Wheeler Via Unsplash)

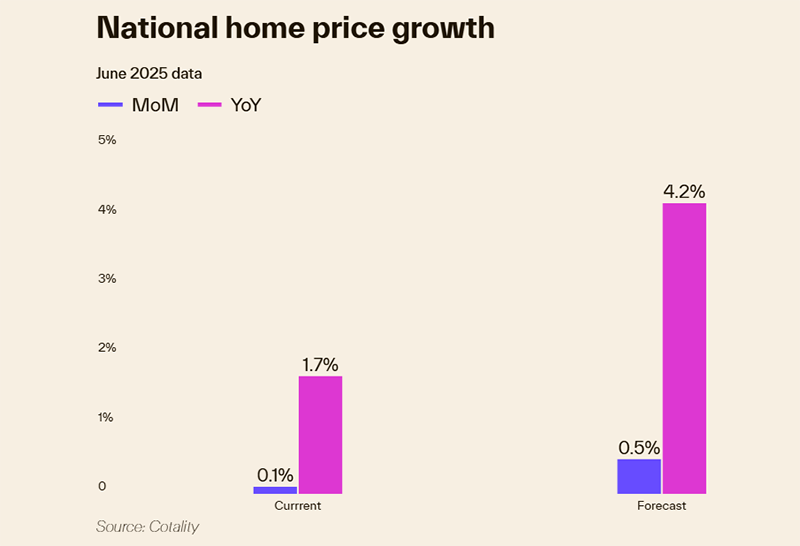

U.S. home price growth remained below 2% in June, indicating a continued market slowdown, according to Cotality, Irvine, Calif.

The firm’s Home Price Index said year-over-year price growth dipped to 1.7% in June, “well below the rate of inflation and [a signal] that real prices may be becoming slightly more affordable.”

The report said housing markets in the Sun Belt have seen particularly noticeable declines, while the Midwest and the Northeast are seeing seasonal price gains that align with pre-pandemic trends. “The Northeast has continued recording strong price growth as compared to the rest of the country,” it noted.

Connecticut, New Jersey and Rhode Island saw the highest annualized price growth during June, posting 7.8%, 7.2%, and 6.6% growth, respectively. “While most of the areas are experiencing a slowdown in annual appreciation, home price appreciation in New Jersey has accelerated in recent months,” the report said. “Similarly, Hawaii and Kansas are appreciating at a faster pace than in April of this year, and a few other states, including North Dakota, Indiana, and Maine, are seeing a similar trend. In addition to the Northeast, the Midwest continues to rank high with robust price growth as the region boasts the highest affordability nationwide.”

Cotality Chief Economist Selma Hepp said slowing price growth and increased for-sale inventories are gradually improving affordability, which has recently been at its lowest levels in more than 30 years. “These changes are creating new opportunities for potential homebuyers who were previously unable to enter the market due to high prices,” she added. “But the extent to which buyers can enter the market is influenced by the stability of the labor market and the absence of major layoffs.”

Though the housing market is seeing slowing price increases, prices are still rising. But price growth is now less than the rate of inflation, which means that relative prices are inching closer to affordability and have laid the foundation for a buyers’ market going forward, the report noted.

“With mortgage rates remaining elevated and concerns about a slowing U.S. economy, subdued demand and downward pressure on home prices is expected to persist, particularly in regions where prices have already decelerated or where recent appreciation has significantly limited local affordability,” Hepp said.