Matic: Home Insurance Affordability Crisis Grows

(Image courtesy of Brett Sayles/pexels.com)

The housing market faces growing challenges as homeowners’ insurance affordability concerns and coverage limitations persist, according to Matic, Columbus, Ohio.

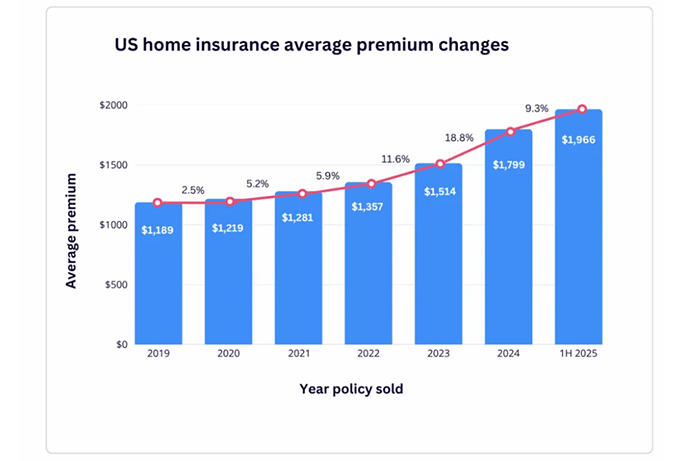

According to Matic’s data, the average home insurance premium for new policies rose 9.3% from 2024 to the first half of 2025, reaching $1,966. “While this marks a slowdown from the steep increases of recent years, it continues a multi-year trend of elevated cost growth,” the report noted. Since 2022, premiums for new policies have increased by 45%, while Coverage A (dwellings coverage) has grown by less than 12%. As a result, many homeowners are paying significantly more for proportionally less coverage.

The report noted premium increases are fueling an affordability crisis and making homeownership less attainable, especially in regions experiencing the sharpest rate hikes.

“In some cases, homeowners are now spending more than half of their monthly mortgage payment on insurance and taxes,” said Ben Madick, CEO and Co-founder of Matic. “An increasing number of people are finding that rising insurance costs are standing in the way of buying a home or making it harder to keep the one they have.”

The report attributed much of the market strain to climate volatility. “While coastal regions have long contended with hurricanes and flooding, parts of the Midwest and Southeast that were once considered low-risk are now seeing an uptick in convective storms, which bring hail and tornadoes,” it said. “These weather events accounted for 70% of global insured losses in recent years and have driven double-digit premium increases in states like Colorado, Mississippi, and Texas.”

Matic noted that insurers are shifting more financial responsibility to homeowners. The average deductible has increased by nearly 25% year-over-year, and many insurance policies are now including separate, percentage-based deductibles for wind and hail damage. “Roof age and condition have also become key pricing factors, with the premium gap between homes with newer and older roofs tripling since 2022,” the report said.

Beyond climate-related factors, the report pointed to federal tariffs as another driver of rising insurance costs. “With tariffs on copper, steel, and aluminum now in place or expected soon, builders are bracing for increased material prices that could raise replacement costs and in turn, premiums,” Matic said.

Challenges in the insurance market affect the mortgage industry, where homeowners must secure coverage to close on a loan. Nearly two-thirds–64%–of lenders Matic surveyed reported issues with insurance either frequently or somewhat frequently over the past year.

“We’re hearing from lenders who are seeing closings fall through or get delayed because of insurance hurdles,” Madick said. “In today’s market, home insurance is no longer a checkbox at the end of the process. It’s a critical step that can make or break a loan, and mortgage leaders who get ahead of it are in a much better position to help their borrowers succeed.”

The report found signs of improvement amid the ongoing challenges. “As the P&C insurance market saw increased profitability in 2024 and early 2025, many carriers began to ease the underwriting restrictions introduced in recent years,” it said. Matic’s data show a 69% increase in available insurance quotes per person between March 2024 and July 2025, indicating more coverage options for homeowners. “While coverage availability remains below historical norms, especially in catastrophe-prone states, the Excess & Surplus market is helping to fill gaps. In California, Florida, and Texas, E&S products now represent 17% of Matic’s home insurance policies — up from less than 2% two years ago — as traditional carriers seek to reduce their exposure in high-risk regions.”