FDTA, SBR, and the MISMO Opportunity: Why Data Standardization Is Mortgage’s Next Strategic Imperative

Modernization is a term that has many meanings—much like innovation. With the push for “deregulation,” the expectations around regulatory guidance and compliance often focuses on less process, less regulator enforcements, and less data demands. Combine these expectations with another year of lending-challenged volumes overlayed by mixed-market indicators, and the residential home sales markets seeking a new trajectory are now looking for comfort wherever possible.

The burden of regulatory compliance will be a hot topic—but even within oversight, there are distinct opportunities for leverage.

Today, industry leaders seeking to map a path forward are often confronted with three tough questions:

1) how to achieve efficiencies with less volume,

2) what does “scale” look like against changing economic realities, and

3) how will data be used moving forward to aid with new requirements and AI analytics and decisioning?

Curious enough, the solution to all three operating imperatives can be found in the design ideation of on-going data modernization initiatives.

On-Going Federal Digital Transformations: The premise of data modernization utilizing digital data is not new. Yet, the explosion of AI capabilities and design formats (i.e., Gen AI, RAG, Agentic AI, Agentic RAG) has created a new cascading series of requirement’s, new and iterative priorities, and new skills that demand interoperability, data-as-a-product, and AI-as-a-Service solutions, which did not exist just four years ago (right before the current industry downturn). Why is this important? What does it have to do with the idea of industry (de)regulation?

Outside the mortgage industry, independent agencies, industry leaders (e.g., CCOs, CROs, CDOs), and vendors, have pushed for data modernization focused on cross-industry consistency between regulatory bodies. The U.S. data modernization efforts started prior to 2014 beginning with the passing of the DATA Act (Digital Accountability and Transparency Act). At a federal level, the early foci was on data standards and types that would be used by all agencies.

This federal mandate was then expanded using the Financial Services and Data Act (FDTA), which was passed in 2022. FDTA is currently in the detailed rule writing and piloting stages as it expands for broader implementations in 2026-2028. For those involved within the mortgage industry and MISMO during the last 25 years, the FDTA’s principle of cross-industry “data-once, use many times” aligns positively with the Association’s lessons learned from lenders and members, agencies, legal and audit, and consumers.

FDTA amends key financial regulatory laws (including the Securities Exchange Act, the Home Owners’ Loan Act, and the Federal Deposit Insurance Act) requiring that covered agencies develop standardized, open data formats for the collection and dissemination of information. FDTA is designed to reduce redundant filings, improve data quality, and allows regulators modern analytics and native machine learning data for submissions.

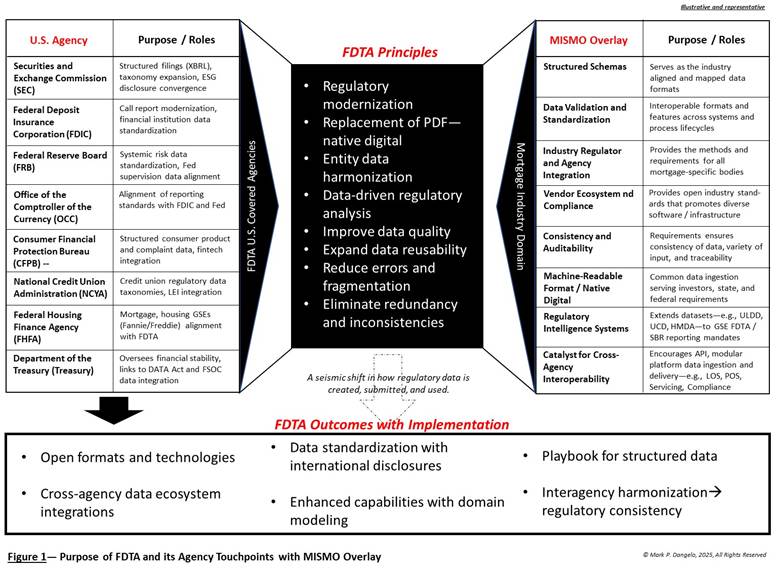

Figure 1 provides a representative scope of involvement from federal agencies coupled with the industry specific impacts that MISMO likely will have as FDTA undergoes broader implementations.

While the implementation of the emerging FDTA demands is still on-going, its legislative intent generally aligns with prior and current MISMO data standard trajectories. Moreover, since the mortgage industry is viewed as an “upstream” feeder to impacted FDTA enterprises (e.g., GSE’s, servicers), the mapping, lineage, and auditing of data from MISMO compliant data sources and workflows minimizes costs and data variability, while delivering scale.

A final contextual note, whereas the emergence of the FDTA does not explicitly identify MISMO, it does specify that regulators should rely on “widely accepted, nonproprietary standards developed through an open process.” Now with increased pressure on deregulation initiatives, a reduction of agencies, and the potential privatization of the existing GSE’s, expanding legislation like the FDTA could afford greater importance to the expansion and adaptation of MISMO especially for varied data types used by AI solutions.

FDTA “Meets” Standard Business Reporting (SBR): The arrival of the FDTA has been repeatedly delayed for a number of “headwind” reasons—costs, impacts on smaller enterprises, rule-writing, government overreach, and cross-agency collaboration.

While the practical demands have been challenging, FDTA was designed to significantly reduce the regulatory burdens created by government agencies each with their own data standards and submission procedures. It was designed to improve data consistency, accuracy, and auditability using consistent data taxonomies and standards. Sound familiar?

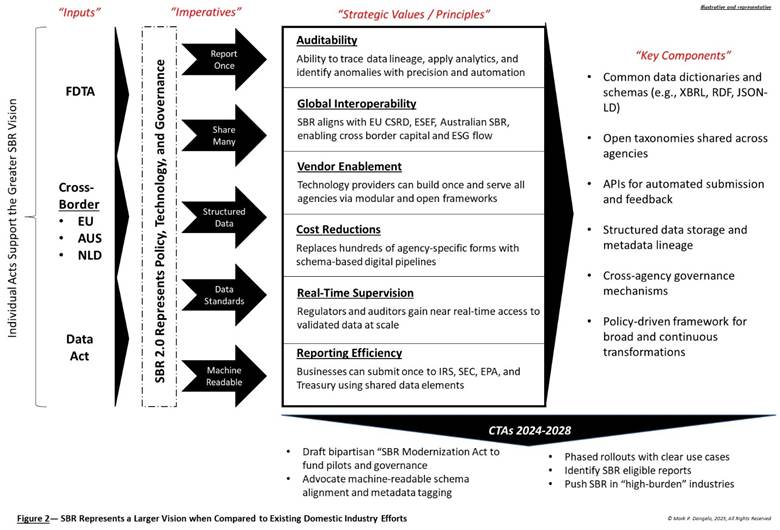

Although adherence to MISMO likely offers a path forward, FDTA is a building block for a larger data modernization initiative—SBR. SBR roots go back nearly a decade in the U.S. and over two decades for international counties (e.g., AUS, NTH, EU). Taken together—the DATA Act, FDTA, and now SBR—it loosely adheres to an engineering process axiom of “crawl, walk, run.” For industry leaders believing that the “smaller” government resulting from budget defunding and firing of protected workers will eliminate data modernization efforts, they may be surprised.

If there are less workers and agencies, the requirements for “doing more with less” will concentrate around standardized data that transforms the data supply chains, which reach investors, consumers, regulators, and yes, politicians. Common data and a robust adherence to standards will escalate resulting in operation system data source changes, and eventually lower costs of active data governance, regulatory compliance, and system interoperability (e.g., data warehouses, marts, APIs, SaaS, and even AI LLMs / SLMs).

To put this all into a common visual, Figure 2 represents SBR and its integration across agencies, across data silos, and across data modernization imperatives.

SBR is a future “regulatory consistency” design—not regulatory compliance. It is already underway and will come after FDTA. For a majority of the independent enterprises within the mortgage industry, the impacts to their daily operations are indirect—but they are an integral part of the data supply chain culminating with SBR as the “end-point.” However, their touchpoints with larger players like the GSE’s means that future data exchanges will be governed by these implied data principles and standards likely in real-time.

Bottom line: As government shrinks, standardized data becomes exponentially more critical. This means data consistency, interoperability, real-time data exchanges, adaptable standards, and active governance. Vendors will adjust their FinTech and RegTech solutions and the impacts will be felt across software, infrastructure, and skill sets needed.

For industry leaders there will be a temptation not to adjust data strategies to meet emerging and future data standardizations requirements—it has been a rough three years. MISMO represents the industry domain data harmonization requirements, which provide robust use cases for loan application and underwriting, closing and delivery, servicing and post-close monitoring.

As the mortgage industry seeks stability amid a persistently challenging lending environment, it is tempting for firms—particularly independent mortgage bankers—to view data standardization mandates like FDTA and SBR as distant or only relevant to larger institutions. That would be a critical miscalculation.

The data modernization underway is not simply regulatory—it is structural. It redefines how data moves through our financial systems, how compliance is verified, and how oversight is automated.

Independent mortgage bankers, by nature of their deep integration with GSEs, servicers, warehouse lenders, and investors, are active contributors to the broader financial data supply chain. Whether or not they directly report to a federal agency under FDTA, the expectation for data quality, traceability, and structure will reach them through secondary and upstream demands. Moreover, the shift toward SBR-style principles introduces a model where data is reported once and reused many times.

For MISMO data standards, this is not a reinvention, but a reapplication. The mortgage industry already has a functioning, widely accepted standard. Aligning MISMO more deliberately with FDTA and SBR principles provides a practical and achievable path forward—one that enables efficiency, reduces cost, and positions lenders to adapt to AI and analytics use cases that demand clean, interoperable datasets.

Mortgage companies that delay data standardization efforts risk compounding costs in the coming years—both in system retrofits and lost market agility. Industry leaders that embrace this shift, especially during a time of low volume and retooling, will emerge better prepared for scalable growth, compliant automation, and native digitally driven oversight.

Data modernization is not about regulatory compliance—it is about regulatory consistency. It’s about enabling a leaner, smarter, and more interoperable and connected industry delivering adaptability to future requirements.

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes submissions from member firms. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)