Snapdocs: More Lenders Offer eClosing, but Adoption Lags

(Image courtesy of Snapdocs)

Snapdocs, San Francisco, released its 2025 State of eClose Adoption Report, finding that 90% of lenders now offer digital closing to their customers. That compares with 74% in 2023.

However, only 14% of those lenders close more than 80% of their loans digitally, and only 31% report closing more than 60% digitally. That’s only up narrowly from 28% that cleared the 60% threshold in 2023.

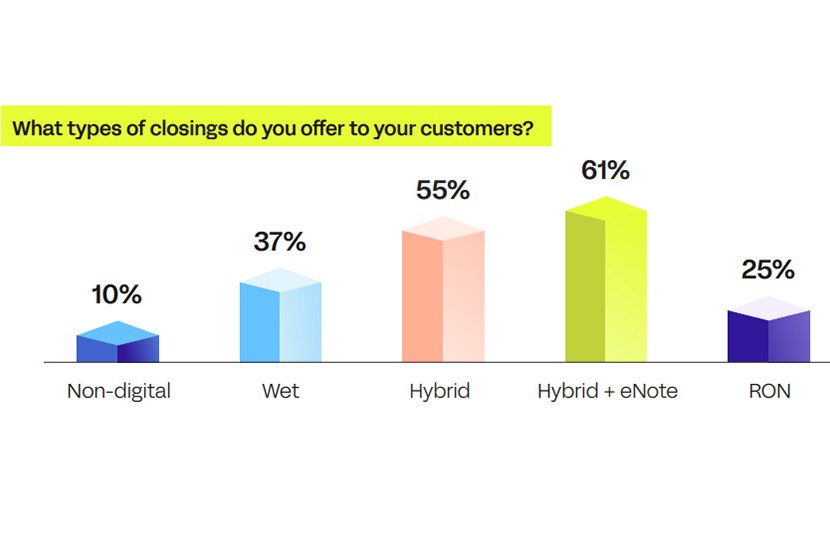

The number of lenders that offer both eNote and RON closings has increased significantly, Snapdocs found, while the chunk of lenders offering hybrid closings was near flat. Lenders offering wet and non-digital closings saw the most significant decline since 2023.

In terms of what benefits lenders see from offering eClosing options, respondents pointed to improving borrower satisfaction, increasing staff efficiency and speeding the closing process, and promoting fewer closing errors.

Respondents reported that cost is their primary barrier to eClose adoption, followed by lack of adoption from stakeholders, issues with the technology, lack of investor acceptance and competing business priorities/lack of leadership buy-in.

Snapdocs also queried the respondents on their technology priorities moving forward, with nearly half–48%–pointing to automation and AI integration as their top priority this year. A third also pointed to efficiency and process optimization, as well as digital transformation or system upgrades.

Many lenders have specific goals related to eClosing, too. Almost half–at 49%–want to apply digital closings, specifically hybrid, to more of their loan portfolio, and 44% report wanting to implement a new digital closing technology.