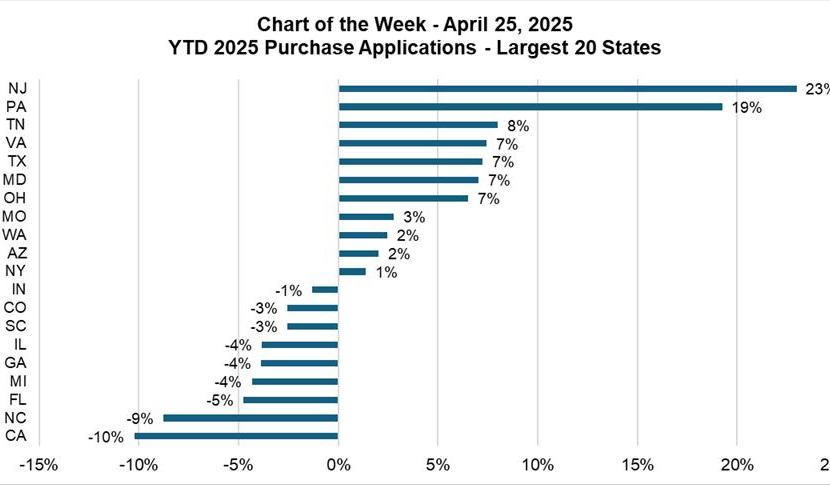

MBA Chart of the Week: YTD 2025 Purchase Applications

Source: MBA State Mortgage Activity Report

Based on an analysis of MBA’s State Mortgage Activity Report data through March 2025, we saw 11 of the 20 largest states experience increases in year-to-date purchase applications, while the other 9 states experienced declines in purchase activity. Nationally, aggregate purchase applications have been showing year-over-year growth since late January, a sign that demand has picked up, and the data tend to have a higher coverage of existing home purchases.

Housing demand continues to be relatively strong, and certain markets have seen for-sale inventory increase, and some of the growth in purchase activity has been driven by this increase in inventory. Mortgage rates are in the high-6 percent range and volatile, but while rates are an important factor in the purchase decision, it is not the only factor. There have been prospective homebuyers in the market, even with higher mortgage rates, but many have been hesitant because of the lack of housing options. However, there are some states where purchase activity is starting to lag last year’s pace, even as inventory is increasing, due to factors such as ongoing affordability challenges, out-migration, and cooling of local markets following a few boom years.

Similarly, house price appreciation (HPA) also varies by geography. According to data from the Federal Housing Finance Agency (FHFA) as of March 2025, U.S. home price growth was up 4.8 percent over the year, with regions such as the East North Central, New England, and Mid-Atlantic showing growth in the 7- to 8-percent range while the Pacific, Mountain, South Atlantic, and East and West South Central saw price growth between 2- to 4-percent. Northeastern states continue to see higher than average price growth and low inventory yet purchase demand remains relatively strong, while some Southeastern states are seeing relatively weaker HPA, higher inventory, and lower demand, which are a cause for concern.

In our April forecast, we expect gradual growth in home sales and purchase originations in 2025 but expect that the growth will continue to uneven across the country depending on market characteristics such as inventory, house price trends, and population flows that are unique to each market.

–Anh Doan, Mike Fratantoni, Joel Kan