March Housing Starts Fall From February

(Image courtesy of Census Bureau; Breakout image courtesy of Kampus Production via pexels.com)

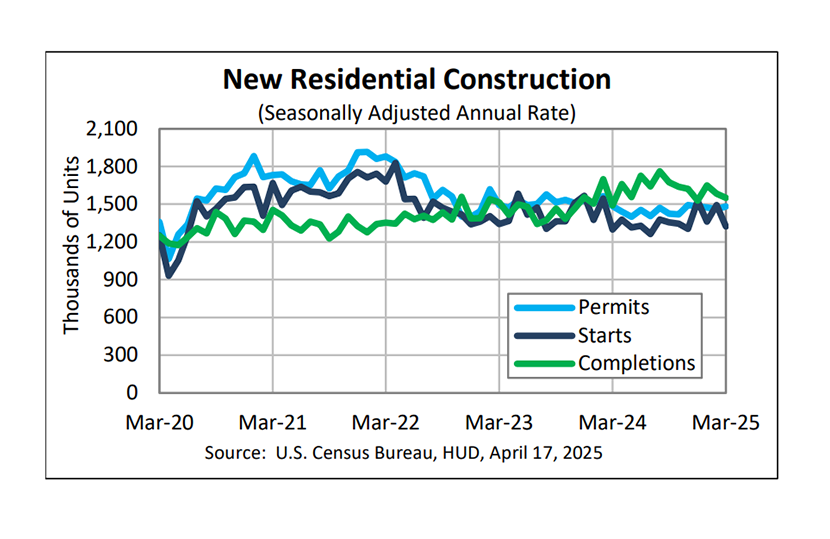

Privately-owned housing starts for March were at a seasonally adjusted annual rate of 1,324,000, the Census Bureau reported. That’s 11.4% below February’s revised estimate of 1,494,000.

However, that’s up 1.9% from March 2024’s 1,299,000 starts.

Single-family starts were at 940,000; 14.2% below the revised February figure. The rate of starts for units in buildings with five or more units was 371,000.

Privately-owned housing completions were at a seasonally adjusted annual rate of 1,549,000, 2.1% below the revised February estimate of 1,582,000. However, completions were up 3.9% from the March 2024 rate of 1,491,000.

Single-family completions were at a rate of 1,029,000, .9% above the revised February rate of 1,020,000. The March rate for units in buildings with five units or more was 503,000.

Building permits for privately-owned housing units were at a seasonally adjusted annual rate of 1,482,000–1.6% above the revised February rate of 1,459,000. That’s 0.2% below the March 2024 rate of 1,485,000.

Single-family permits were at a rate of 978,000 in March, 2% below the revised February figure of 998,000. Permits for units in buildings with five or more units were at a rate of 445,000.

“Builders pull back more than expected amid rising tariff uncertainty, as housing starts slump well below consensus expectations. Builders face persistent supply-side and affordability challenges, from higher material costs to a shortage of skilled labor. Residential building material costs are still more than 40% higher than pre-pandemic levels, making construction more expensive,” said First American Deputy Chief Economist Odeta Kushi. “Recent tariff actions could push costs even higher, with builders estimating an additional $10,900 per home. If these tariffs persist, builders will have no choice but to pass on the costs to consumers, who are already struggling with housing affordability.”

“The slower pace of single-family permits suggests a reduced rate of groundbreaking in the upcoming months, due to higher inventory levels in key markets and ongoing challenges with costs and affordability,” Kushi continued.