Understanding the Playbook for Distressed Asset Due Diligence

A resource for NewsLink readers by Partner Engineering and Science, Inc. and Partner Valuation Advisors.

It’s a good time to brush up on the essential tools of distressed asset due diligence, says Erika Haberlen, Head of Marketing, Principal with Partner Engineering and Science, Inc. and Partner Valuations Advisors. Haberlen prepared a helpful Q&A guidance to help lenders, special servicers, attorneys and others refresh on the process and key due diligence tools to help manage risk, guide decision-making, and preserve value in a loan workout situation.

Q: What should lenders do when a loan starts to exhibit signs of distress?

A: Lenders should take a closer look at the property and prepare for potential decisions. Due diligence is more involved in pre-foreclosure situations than during loan origination. New factors such as local ordinances, environmental standards, and the need for customized reports have emerged since the last downturn.

Q: What are the key components of the distressed asset due diligence toolkit?

A: The toolkit includes several reports and considerations, chiefly including:

• Valuation: Understanding why the asset is distressed, market analysis, and determining the highest and best use of the property.

• Phase I Environmental Site Assessment: Identifying environmental liabilities and potential immediate action needed to avoid future liabilities.

• Property Condition Assessment: Evaluating the physical condition of the property and identifying necessary repairs.

• Zoning Report: Checking for zoning compliance and potential risks.

• ALTA Survey: Satisfying title insurer requirements and understanding property boundaries and conditions.

These key tools are discussed in more depth below, as well as other due diligence or further investigations that may be warranted based on the property type and situation, for example construction loans.

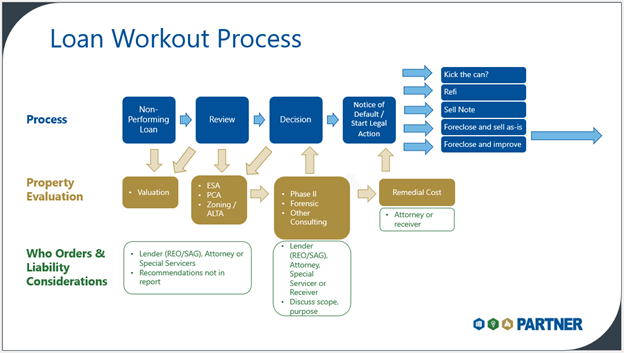

Q: When and how do these due diligence tools factor into the loan workout process?

A: We have put together two helpful flowcharts to understand at what stage of a distressed loan the key due diligence tools can be employed to manage risk, aid decision-making and preserve value.

Q: How can a valuation advisor help guide decision-making in a distressed loan situation?

A: Early in the process, it is important to get a handle on the value of the property and what the key drivers are. In a non-performing loan situation, the appraisal is generally engaged by either the borrower, lender, special servicer, or an attorney on behalf of one of these parties.

A good valuation advisor will help the lender or other parties address key questions such as:

• Understanding the why: Why is this asset distressed? Is it a market issue (too much supply)? Is it a borrower issue where this asset was cross collateralized with others and this property is distressed due to challenges at other borrower owned properties? Has the property been poorly managed? Is it a recent issue or long-term problem, and why?

• Market analysis: How is this property positioned within the market?

• Is the current use of the property the highest and best use? If not, what is?

• What types of buyer (REIT, insurance company, pension fund, individual, partnership) would purchase the property and why?

The valuation consultant will likely apply a combination of approaches to value including the cost approach, sales comparison approach, and income capitalization approach (direct capitalization and discounted cash flow analysis).

Q: How is environmental due diligence different during a distressed loan scenario?

A: For lenders that have no intention of taking back a property but rather selling the note, they may skip doing any new environmental due diligence on the asset and leave that up to the note buyer. However, if there is a potential for a foreclosure outcome, a full Phase I Environmental Site Assessment (ESA) will help them understand and avoid taking on environmental liabilities with the property. A lot of environmental regulations have changed in recent years – the standard for Phase I ESAs was updated, cleanup levels have changed, and PFAS is newer concern to be considered – so whatever was done at origination would need to be updated and a “clean” Phase I at origination may not mean a clean Phase I now.

If during the Phase I process a REC or “recognized environmental condition” is identified, the Phase I will often include recommendations for further investigation, but in a potential foreclosure many lenders may not want to see that recommendation in the Phase I ESA itself – recommendations can be given via a separate letter to legal counsel to afford the lender greater latitude in how they wish to proceed.

Depending on the property, the lender may need to go beyond the typical Phase I ESA scope to address building hazards like moisture and mold, asbestos, lead and radon. An Operations & Maintenance plan will ensure any known asbestos or lead containing materials are managed safely. If renovation is necessary during the hold period, an asbestos survey should be done beforehand. Additionally, for properties with hazardous chemicals or environmentally sensitive operations (think gas stations, auto shops, retail with dry cleaning tenant, manufacturing), a hazmat inventory and/or compliance audit would help the parties understand what materials and operations need to be dealt with during the hold period to avoid any future liabilities.

Should an environmental concern be identified, the lender isn’t necessarily obligated to investigate or clean it up, but for valuation purposes they will likely want to get a handle on the costs to clean it up. A Phase II Subsurface Investigation and/or Remedial Cost Estimate can help quantify the extent of the problem and cost to cleanup.

Lenders should avoid directing certain activities because it could open them up to liability – for example if hazardous waste needs to be removed from the property, this should be done by the borrower, guarantor, tenant, or receiver. Sometimes an attorney is best placed to order reports in order to preserve confidentiality.

Q: Why is a Property Condition Assessment important and how is it approached differently in a loan workout?

A Property Condition Assessment (PCA) is critical early in the process because the physical condition of the building can substantially impact property value and the decision making around a non-performing loan. Additionally, building systems are always in a state of decline, and distressed assets can enter a downward spiral where deferred maintenance leads to increased vacancy and further revenue struggles, leading to accelerated building systems decline, and so on. For these reasons, any PCA done at origination is a snapshot in history and should likely be redone.

The approach to a pre-foreclosure PCA is different than the approach at origination because the evaluation should be done with more of an equity lens. Developing a solid understand of the building condition and all the issues is critical so that when the asset goes to sale, the deficiencies are priced in already backed up by the PCA, there are no surprises and no grounds for a retrade. Alternatively, the deficiencies can be corrected before the sale, or a warranty or contingency can be arranged. This is also why in a pre-foreclosure PCA there is a need for greater accuracy in the opinions of cost than the general industry standard costs typically used for debt PCAs. Adding sub-specialists to the assessment such as for the elevator or roofing systems will pay for itself through property value improvement and minimization of re-trade risk. Furthermore, once a lender owns a property, life safety issues become their liability so identifying them is key in the PCA process.

Additionally, in a pre-foreclosure scenario, the PCA cost tables typically have shorter terms. This is because once foreclose happens, disposition of the property as soon as possible is generally the goal. Lenders need to understand what’s wrong with the property right now, what the major issues are, what needs to be repaired immediately to prevent further deterioration. On distressed assets, the lender and PCA consultant are typically not concerned with every minor dent and ding, or what needs to be replaced 10 years from now. Therefore, instead of a standard 12-year replacement reserves table, lenders generally want a much shorter term, often 3 or 5 years. Some lenders don’t want any reserves at all – it’s a case-by-case scenario depending on how they’re going to handle the situation.

Q: How do Zoning Reports and ALTA Surveys help guide decisions in loan workout scenarios?

A: Zoning Reports and ALTA Surveys are things that lenders may or may not order during origination but in a pre-foreclosure scenario they can uncover important information that affects the current and future use and value of the property:

• Zoning Report – Understanding the zoning compliance of a property will alert the lender to non-conformances or violations that could pose a risk of loss in the event of a casualty, i.e. a fire. It will also review publicly available information about new or proposed legislation, zoning laws, or moratoriums that would affect the property.

• ALTA Survey – An American Land Title Association (ALTA) Survey is essential to satisfy the title insurer’s requirements for issuing ALTA Title Insurance to cover survey risks such as encroachments, boundary disputes, etc. An ALTA Survey essentially an aerial snapshot of existing conditions of the property, so it is a useful tool to understand exactly what is being conveyed with a property.

Q: What should be done for troubled construction loans?

A: A proactive and preventative approach to monitoring construction loans is wise even in performing loans. When signals of distress arise, time is of the essence – problems can escalate quickly, especially if work stops on a site. For construction loans that start to exhibit problems, lenders need to act swiftly to get a handle on the project, minimize loss, and make sure it gets finished.

• A Construction Status Review is a third-party observation of the site conditions such as % complete, site access and security, stored material, weatherization and other conditions. It also includes a review of key documents such as contracts, bonds, lien releases, insurance, drawings, schedules, approved payment applications, and others. The Construction Status Review evaluates whether subs and suppliers are paid to date, and include interviews with key stakeholders like the GC, major subs and suppliers, and the owner and/or developer. This is also a good time to evaluate the GC’s ability and willingness to continue with the project, which is the path of least resistance because other GC’s may be reluctant to step in.

• If another lender steps in to either buy the note or inject additional capital, a Cost to Complete should be done to give the new lender a picture of what the costs are to finish the project to the original specs, and potentially analysis on finishing vs demolishing it.

• Stabilize and secure the site if construction stalls. This includes winterizing or weatherizing the project, putting erosion control measures in place, accounting for stored materials, and ensuring proper site security. At this time the subs may need to be negotiated with and demobilized or replaced.

• Ensure the project gets finished through regular progress monitoring and stringent control of funds to ensure that payments are in line with progress at the site.

Q: What expectations should lenders communicate to their consultants in the loan workout process?

A: It is essential that the lender communicates that this is a potential foreclosure situation to the third-party consultant, along with their expectations and foreclosure policy. This ensures that the reports can specifically meet a foreclosure scope of work, and helps the consultant put on the lender’s hat and look at things from their perspective – a little more of an equity lens focused on understanding the big issues, stabilizing the site, and facilitating disposition of the asset.

The lender should also instruct the site assessor on exactly what and what not to reveal in their communications with the site contact before, during or after the inspection. The tenant and/or borrower may not be aware of the reason for the site visit, and the borrower should not learn that they are being foreclosed on from a third party! The consultant may need a good “cover story”.

One of the biggest and most common challenges in this process is site access. The borrower may be unresponsive or uncooperative. The consultant should be instructed to document all communications or attempts. If possible, the lender should avoid settling for site assessments that don’t include interior access, because building condition and potential hazards can significantly affect value and the decision-making process. The lender may want to seek legal counsel on best approach.

For more information

We hope this resource helps you better navigate process of a loan workout, minimize liabilities, preserve asset value, and guide in decision making. For further information, visit Partner’s resource center for glossary terms, articles, webinars and other guidance on due diligence and the science of real estate.

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes submissions from member firms. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)