Down Payment Resource: 43 New Assistance Programs Added in Q1 2025

(Image courtesy of Down Payment Resource)

Down Payment Resource, Atlanta, released its Q1 2025 Homeownership Program Index report, finding that 43 programs were added in the quarter. That brings the total number of available programs to a report high of 2,509.

There are 55 more entities offering homebuyer assistance programs since Q1 2024.

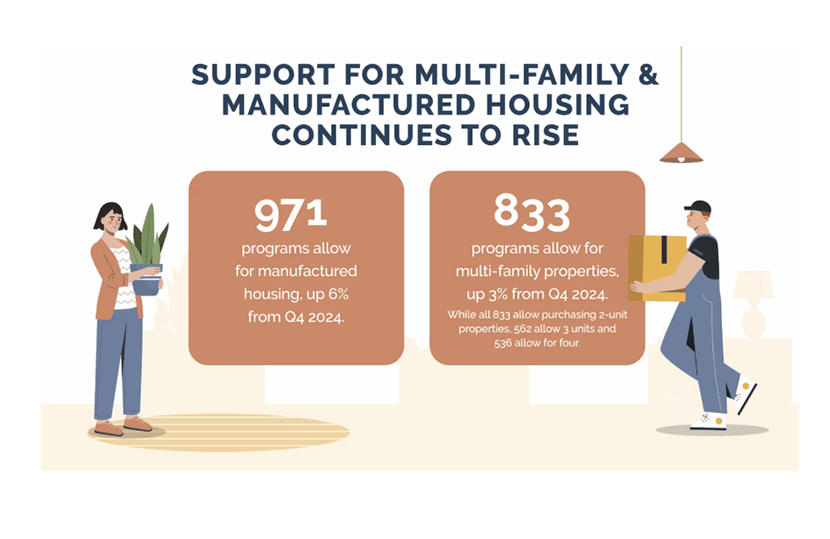

A total of 833 programs now support the buying of multifamily properties, up 3% from Q4. Of those, 562 allow for 3-unit properties, up 4% from Q4, and 536 allow for 4-unit properties, up 4% from Q4.

And, the number of programs supporting the purchase of manufactured housing has grown from 914 in Q4 to 971 in Q1–a 6% increase.

Program types saw some changes from the previous quarter. The other homebuyer assistance, below market rate/resale restricted, grants and second mortgage categories made quarterly gains.

There were slightly more programs–up by 3%–reserved for first-time buyers, from 1,518 in Q4 to 1,557 in Q1.

Municipalities were still a majority of funding sources, at 39% of totals for the first quarter. That’s up slightly–2%–from the previous quarter. Nonprofits represented 21% of funding sources in Q1, followed by state housing finance agencies at 18%.

Of the 2,509 programs, 81% are funded, 10% are inactive, 4% have a waitlist for funding and 5% are temporarily suspended.

“Rates are still high and prices keep climbing, but we’re seeing expanded program offerings, new providers and greater flexibility in how funds are used–not just for down payments but also to cover closing costs, lower the rate or meet other buyer needs,” said Rob Chrane, Founder and CEO of DPR. “More programs now include manufactured and multi-family homes, opening new paths to affordability and steady income. For lenders, that means more ways to qualify buyers and close loans in a tough market.”