Auction.com: Foreclosure Auction Volume Hits Six-Quarter High in Q1

(Image courtesy of Auction.com; Breakout image courtesy of Natália Oliveira/pexels.com)

Auction.com, Irvine, Calif., found foreclosure auction volume was up 4% annually in the first quarter, to notch a six-quarter high.

Completed foreclosure auctions were also up 20% from Q4 2024. The January numbers specifically were a 21-month high, propelling in part the results.

The total completed auction volume for the quarter recovered to 49% of pre-pandemic levels, up from 41% in Q4.

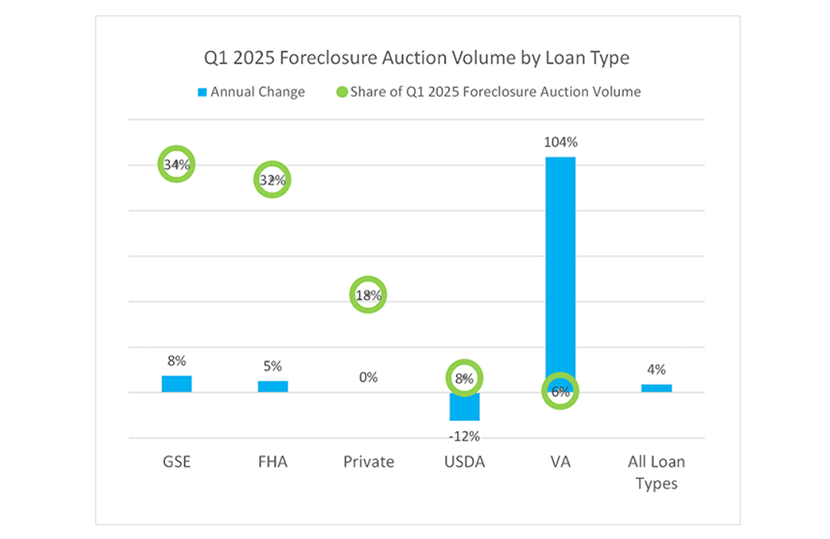

Foreclosure auction volume was up across all loans except for USDA loans. VA loans saw a 104% annual increase in foreclosure auction volume, after the nationwide foreclosure moratorium expired at the end of last year.

Scheduled foreclosure auctions were up 14% from the previous quarter to a five-quarter high.

The overall Q1 foreclosure auction sales rate–the share of properties available at auction that sold to third-party buyers–was essentially flat from Q4 and down annually, as activity was strong in January but weakened in February and March.

Price demand, defined as the amount buyers at auction are willing to pay relative to estimated after-repair value, was near flat in Q1. Foreclosure auction price demand was at 56.7%, up slightly from 55.9% in Q4 but down from 59% a year earlier. REO price demand was up 3% quarterly and 1% annually to 57.9%.

The gap between what buyers are willing to pay and what sellers are willing to accept–the bid-ask spread–varied based on auction types.

For foreclosure auctions, the spread was at 7 percentage points in Q1 2025, flat from Q4 but up significantly from 3 percentage points at this time last year.

For REO auctions, it narrowed to 10 percentage points, compared with 12 in Q4 and flat from Q1 2024.