Foreclosure Activity Drops, ATTOM Finds

(Illustration courtesy of ATTOM)

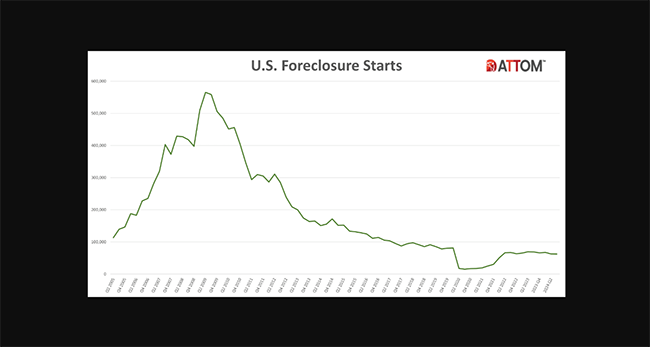

ATTOM, Irvine, Calif., said U.S. properties with foreclosure filings are falling, down 2% from the previous quarter and down 13% from a year ago.

The firm’s Q3 2024 U.S. Foreclosure Market Report found a total of 87,108 U.S. properties with a foreclosure filing during the third quarter and 29,668 foreclosure filings in September.

“While we are seeing a decrease in foreclosure starts and repossessions, it’s crucial to remain vigilant, as any economic disruptions or changes in interest rates could shift the current trend,” ATTOM CEO Rob Barber said. “Moving forward, we anticipate foreclosure levels will stay relatively low, but there could be localized increases in areas struggling with affordability or other market pressures.”

Foreclosure Starts Decrease Nationwide

A total of 62,380 U.S. properties started the foreclosure process in Q3 2024, down less than 1% from the previous quarter and down 10% from a year ago.

States that had 1,000 or more foreclosures starts in Q3 2024 and saw the greatest annual decrease included North Carolina (down 44%); Georgia (down 29%); Maryland (down 22%); New Jersey (down 20%); and South Carolina (down 19%).

Highest Foreclosure Rates in Illinois, Nevada and Florida

Nationwide, one in every 1,618 housing units had a foreclosure filing in Q3 2024. States with the highest foreclosure rates were Illinois (one in every 904 housing units with a foreclosure filing); Nevada (one in every 922 housing units); Florida (one in every 971 housing units); Delaware (one in every 1,060 housing units); and South Carolina (one in every 1,069 housing units).

Average Time to Foreclose Increases 6% From Last Year

Properties foreclosed in Q3 2024 had been in the foreclosure process for an average of 815 days. This remains the same from the previous quarter but represents a 6% increase from the same time last year, continuing an upward trajectory since Q3 2023, ATTOM found.