FundingShield: Fraud Risk Report Shows Slight Drop

(Image courtesy of FundingShield)

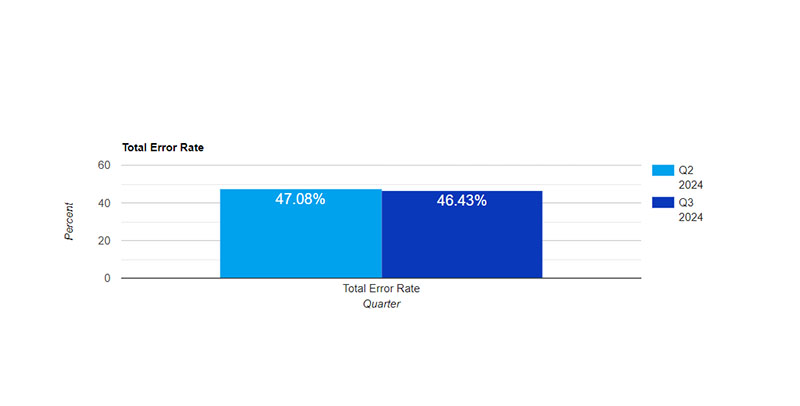

FundingShield, Newport Beach, Calif., found that during the third quarter, 46.43% of transactions on an $82 billion portfolio of residential, commercial and business purpose loans had issues leading to a risk of wire and title fraud.

While that’s still nearing half of all transactions, it is a slight dip both from Q2 (47.08%) and Q3 2023 (49.2%).

On average, problematic loans had 2.23 issues per loan, a new record average per loan.

In particular, the quarter saw record-high risk levels for CPL-related issues at 45.1% of transactions, including critical data points such as borrower information, vesting/vested parties, non-borrowing parties on title and property addresses.

CPL Validations, agent good standing, issuance limits and title file order registration issues in title insurance systems stood near the all-time high in Q3, at 9.6%

Wire-related issues were present on 8.1% of transactions–the fourth straight quarter where the category clocked in at more than 8%, but a drop from last quarter’s 8.78%.

License issues increased by 24% from Q2 to Q3–FundingShield pointed to entities having lapsed, terminated or suspended licenses and inconsistent data when verified with registrars, insurance regulators and licensing bodies. They stood at 1.9% at the end of the quarter.

E&O issues fell from 1.2% to 1%.