CAIO: Shepherding the Talent, Technology and Context for Continuous AI Deployment—Mark Dangelo

As AI becomes robust and pervasive, the demand for proactive management of emerging solutions grows. To address the imperatives and demands for efficiencies and scale, boards and CEOs will increasingly include a highly trained and focused leader–the Chief AI Officer (CAIO).

In a short 24 months, artificial intelligence (AI) discussions now appear in all aspects of the banking and financial services industry (BFSI). As the Mortgage Bankers Association and its members prepare for their annual conference, the topic will dominate sessions, the exhibit hall, and even daily entertainment. It is inescapable as it captures the imagination of industry leaders, while promising efficiencies, leverage, and process simplifications. What could go wrong when vendors, outsourcers, and even academics promote next-generational solutions wrapped in natural language processing?

Yet the dilemma for board of directors (BOD) and C-levels is how to integrate rapidly iterating AI capabilities. Where will AI impact existing initiatives and budgets? What designs and audit approaches will deliver transparent regulatory compliance? And most importantly, who will be tasked with ensuring adoption, consistency, and adaptability?

During 2024, forward-looking BFSI and mortgage leaders began experimentation with an emerging C-level position—the Chief AI Officer (CAIO). Whereas the “Why” of AI oversight is increasingly obvious—leverage, reusability, risks, expenses, context, staff and expertise—the details surrounding the tasks, activities, and responsibilities are emerging and opaque depending on the organizational size, strategy, and innovation culture.

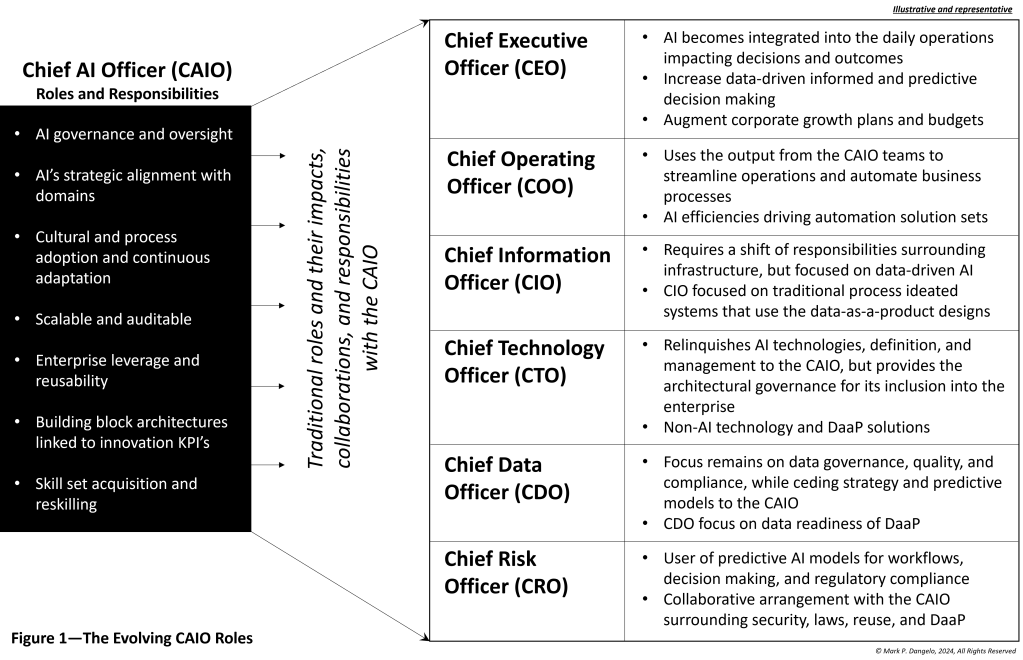

To frame the unknown and to provide successful integration of a next-generational C-level role specifically around AI, let’s examine a series of “build” graphics that discuss the roles and responsibilities of a CAIO within the mortgage and financial industries. As broken down in Figure 1, a comparison and contrast between the CAIO and six common C-levels illustrates the changes already underway within enterprises as they rush to carve out and identify AI’s on-going needs and scalability.

As represented, the CAIO roles and responsibilities represent new demands, while at the same time extracting traditional roles that previously were traditional C-suite functions across point-based AI solutions. However, is the CAIO just a vertical function leveraged by the CEO and COO to drive budget efficiencies? As the mortgage industry begins a resurgence of business and volumes, what will the CAIO deliver that transforms the products, services, and point-based solutions? Will the CAIO be able to show value and returns quickly, or will it require extensive trial and errors to adapt rapid-cycle technologies geared towards process solutions into a product design for algorithmic designed data extensibility and auditability?

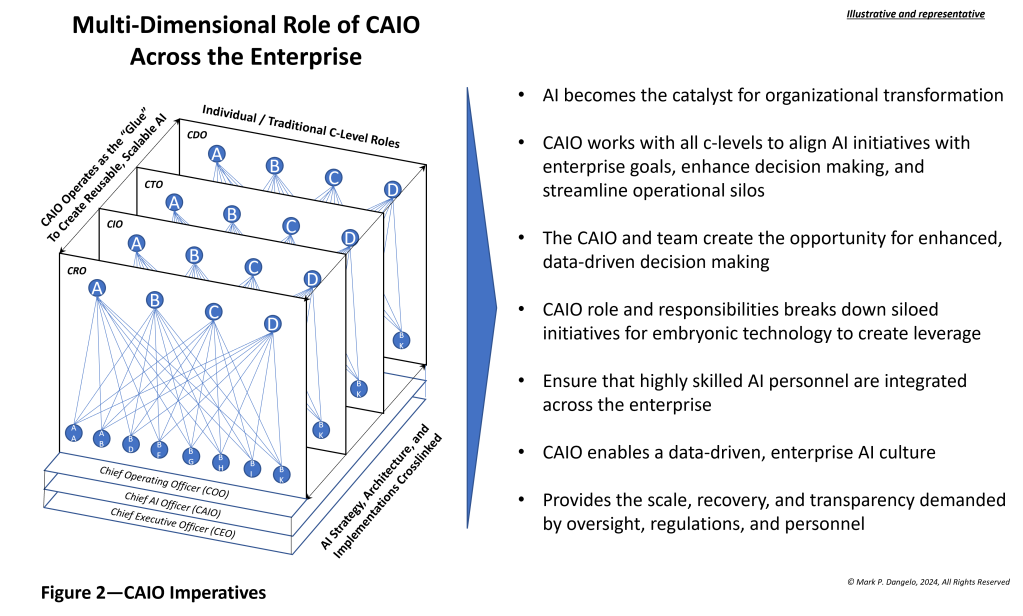

To address these challenges and to show the integration within existing C-suite leadership, Figure 2 provides an illustration of how to effectively “connect” the iterative CAIO role with AI imperatives that already exist within the mortgage industry—albeit within siloed processes and departments.

The left side of Figure 2 shows the touchpoints between the CAIO and other C-suite executives as well as the integration strategies used to enhance organizational performance for enterprise AI efforts. Moreover, the right side provides the “user stories” and functions that are necessary to deliver the success criteria, which will be used to monitor progress and continuously iterate the CAIO’s ambiguous mission. The representative “epic” user stories create the enduring context necessary to make the CAIO successful within a changing, transformative delivery role (more than strategy).

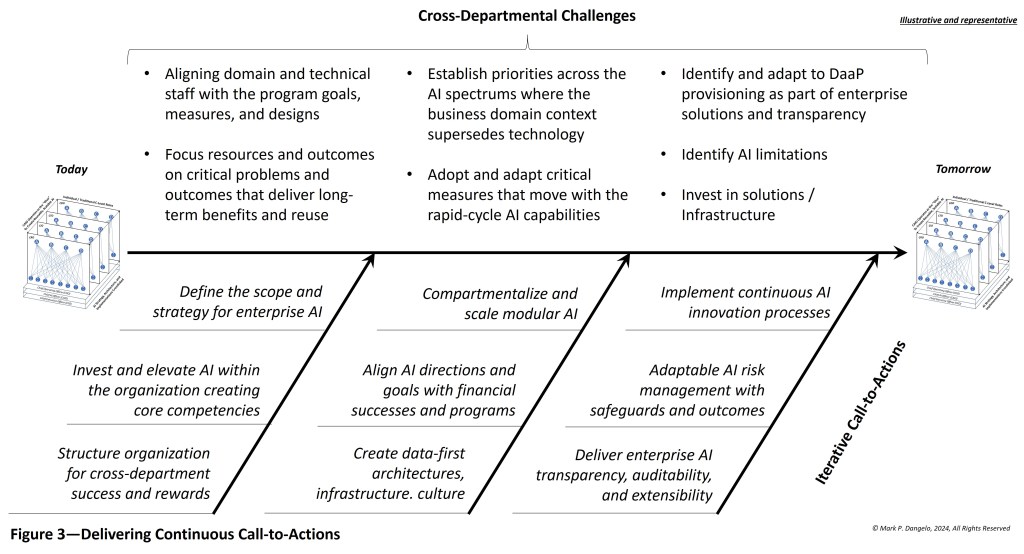

Whereas we could end the discussion here, without providing action, there needs to be a roadmap with discrete efforts to identify emerging challenges over time. Figure 3 builds off the priorities and visualizations of the preceding two diagrams and showcases iterative call-to-actions.

Taking the diagrams in their totality, they provide the foundational boundaries and actions necessary (from the vantage point of today) to define the CAIO role. From the contrast against traditional C-suite executives, to the touchpoints within the enterprise, to the call-to-actions to address the emerging challenges, the framework for the CAIO can be established.

It should be noted that the creation of the CAIO resembles the technologies and data sought to be leveraged (i.e., it lacks a steady state). The role will be iterative, deficient in historical references, and require innovative flexibility, which may run counterculture to traditional mortgage and banking leadership.

In the end, the CAIO will be responsible for:

Using AI as a catalyst for data and process transformations,

The integration expertise between AI technologies and business drivers,

Turning department and process pilots into scalable, reusable solutions,

Identifying and mitigating AI risks that will continue to emerge in concert with AI complexity and cascading outputs,

Delivering efficiency forecasts into financial realities,

Ensure privacy, security, and ethical conduct of AI solutions,

Enhance predictive and event driven (data) forecasts using layered, intelligent decisioning, and

Identifying and building a workforce that embraces AI while understanding its limitations.

Mortgage and banking leaders will continue to embrace and debate the use of a CAIO within their enterprise. If the last 24 months of AI progress, adoption, and hype are any indicators of the future, the CAIO role will witness fast inclusion into all aspects of decision making, while at the same time struggle with stable roles and responsibilities common with traditional C-suite roles.

It is not an “if”—but a “when” the CAIO will be a common role across BFSI and mortgage enterprises.

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)