A Nexus of Complexities Facing Mortgage Leaders: Mark Dangelo

The politics of innovation and technology are dramatically altering discussions and selection processes. Creating optimal strategies and deploying efficient learning solutions requires identifying new demands, requirements and data differentiators compared to traditional business as usual.

In a year of presidential politics, the sound bites never seem to end—or become more pointed. Prior cycles, while sharp and cutting based on ideology, have now enveloped rapidly emerging innovation and technological advancements. From Tik Tok to artificial intelligence (AI) to privacy to cybersecurity, innovative advancements have pushed the boundaries and the potential impacts on workers, skills, software, products, services, and rights.

State and Federal (executive) orders and legislation surrounding ethically sourced data, its manipulation, and its sharing has led to a patchwork quilt of compliance demands directing challenges to First Amendment rights and business model efficacy. Moreover, will the challenges to traditional modes of operation improve the estimated $2 trillion in home originations for 2024 (e.g., per loan margins or yield greater unit sales)?

Currently, when it comes to AI it is both an angel for efficiency projected to add trillions in USD to economic growth and insight, and a data-driven demon that is opaque, eliminates jobs, and threatens living standards. When examining the impact to mortgage per loan margins, the reduction of a single person hour spent during the origination cycle can yield $110 to $140 per loan, embryonic solutions of ML, AI, and neural network innovation hold both great promise and fear . For mortgage firms struggling with a four-decade low in housing affordability, availability, and volume, every margin improvement is critical to survivability.

Therefore, what approaches could be utilized to “depoliticalize” critical, future solution sets (e.g., AI, DaaP, multimodal architectures)? There is not a “one-size fits all” solution as it is dependent on demographics served, infrastructure deployed, and skill sets available. To understand and assess organizational options for innovations and technologies that will continue to be politicalized, organizational leaders must change their approaches to how innovation is adopted, adapted and improved. Unlike the system ideations based on process automation of paper-based systems, these next-generation of data-driven solutions must:

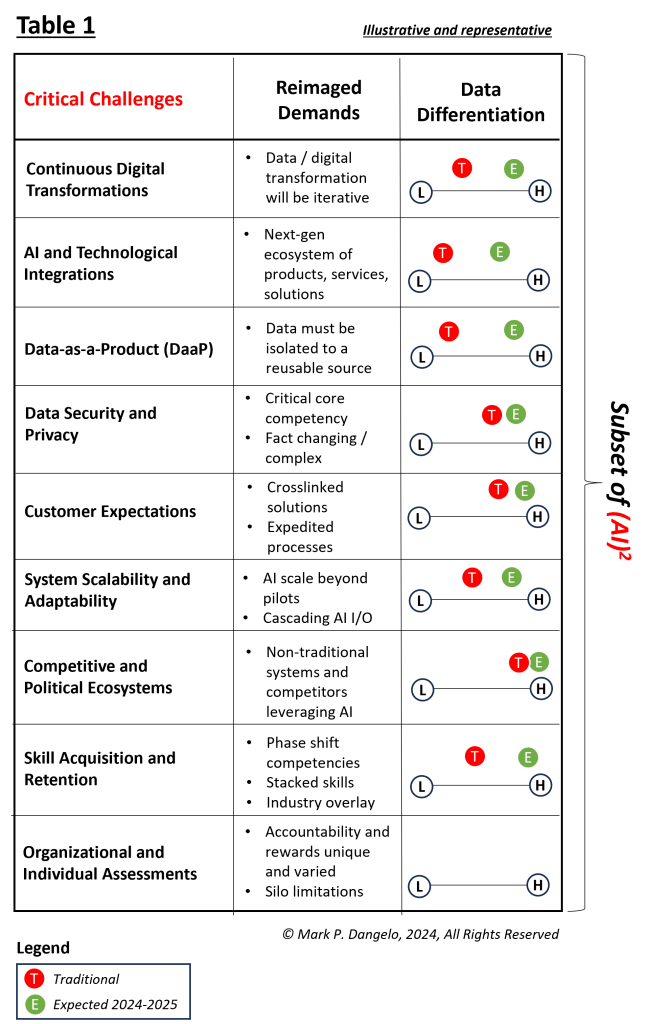

– Recognize the critical challenges facing traditional processes and implementations (see Table 1),

– Map the challenges against business model shifts that will be forthcoming regardless of politician and media “facts” (see Table 2),

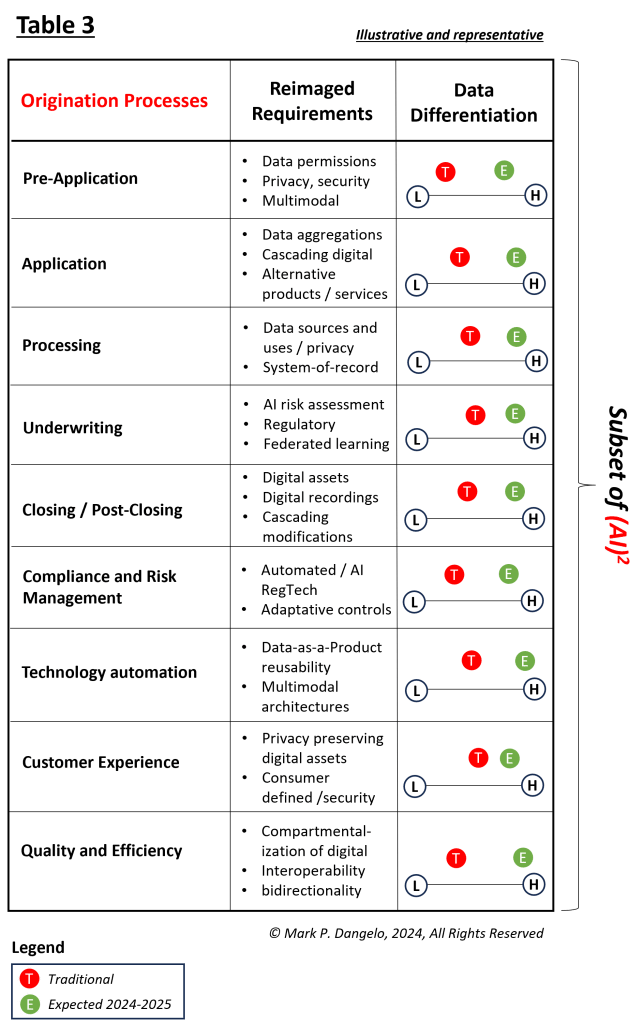

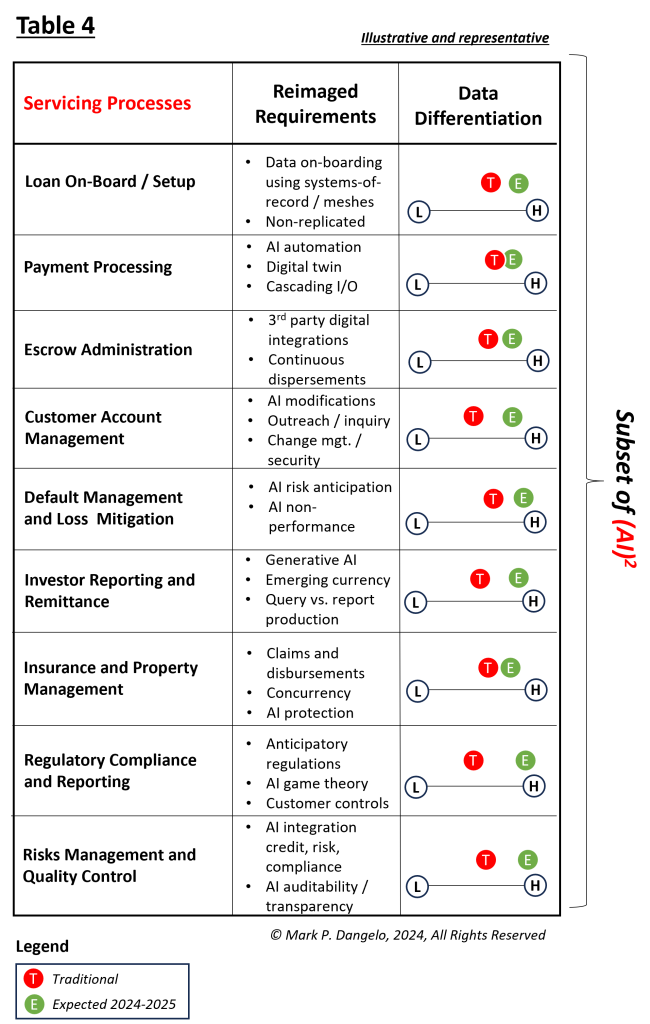

– Break out the impacts across three macro mortgage processes—origination, servicing, and securitization (see Tables 3, 4 and 5 respectfully) as part of prototyping, piloting, and scaling for production, and

– Develop iterative roadmaps of action and implementation using short bursts of activity (e.g., Agile) to incrementally deliver the necessary outcomes and desired results.

The methodology used for the above is (AI)2 (Adjust, Innovate, Action, Iterate) surrounding distinctive use cases as it represents a next-gen approach to adopting data-driven solutions that have robust impacts (i.e., AI). The design and deployment of (AI)2 delivers the industry data differentiations which will be downfall for many enterprises as they rush to move siloed innovative pilots into scaled production systems impacting crosslinked critical controls within legal, auditing, and regulatory compliance.

What are the Critical Challenges?

Whereas the tables following are illustrative and representative of a holistic approach, they provide the practical challenge areas and implied questions that need to be asked. In Table 1 for example, is your enterprise prepared for continuous digital innovation? When it comes to AI, are you talking about chipsets, algorithms, machine learning, generative versus general, or what about all the fragmented data? How will all these impressive, point systems be integrated and what will the cascading impacts be both upstream and downstream from where these innovations start—and end?

What are the Business Model Shifts Created by Challenges?

The business models of the mortgage industry have never been under a nexus of pressures—politics, innovation, aging workforces, regulations, consumer shifts, commoditization of products and services. The lasting impacts of these shifts might suggest that a wave of mergers, acquisitions, and divestures (MAD) should be consuming an industry that until 2023 could not keep up with demands—that mindset is likely misguided.

The reality is that with the rapid advancements in data and its usage, the “book-of-business” drivers to gain scale and customer base is not the differentiator it was previously. When we look at a few of the business model shifts already underway, we can see a material difference in the model of profit and loss as well as their longevity (see Table 2). MAD will happen, but paying a premium for customer contacts is likely a thing of the past.

What are the Impacts Beyond the Siloed Features?

With the challenges understood and the model impacts identified, the implications for the processes and systems across origination, servicing, and securitization are not trivial when it comes to next-generation innovations. Making it more complex is the cycle time or longevity of the discrete solution sets and the organizational skills and culture necessary to adapt to differentiators that may only last a few months—not years.

Tables 3 through 5 illustrate the industry approach to using (AI)2 as compared to traditional approaches internalized during the last 15 years, much of it driven by cloud provisioning over on-premises build outs. The reimaged requirements represent significant differences compared to process defined automation common with SaaS solutions and vendor defined value.

Roadmaps and Iteration are the Building Blocks

The representations in Tables 1 through 5 showcase a new model to address and profit from the shifts taking place across the mortgage markets. It was just a year ago that real estate agents were significantly profiting from sellers—we know how that ended.

The next traditional market of this cycle resides with the mortgage industry. The pain continues to happen even though most of the GSE projections believe that 2023 was the “trough of disparity” and that 2024-2025 will see approximately $400 billion added per year (a combination of home appreciation, tight markets, and aging Boomers).

Yet, the fulfillment of three macro mortgage macro solutions starting at its ethically sourced data, promises to fundamentally transform how mortgage processes are done. The industry using AI as a catalyst will alter its models of operation and its technologies.

And, while vendors and startups highlight their innovative capabilities, the methodologies and outcomes demanded are quite different. If we examine the Table features above and the “data differentiations” that are implied from the reimaging of the mortgage industry, we arrive at a future model that may be politicized—but is all about the data.

Industry leaders can fight the trends. Industry leaders can surround themselves with individuals and vendors that promote traditional ideas with new wrappers. Industry leaders can shield themselves with the very regulations they find distasteful. In the end, the industry will be changing and experiencing regrowth. It remains to be seen who will grow against the future models as 2024 season ramps into a crescendo of activities as compared to those anticipating more of the same.

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)