Agustin Del Rio: Don’t Cry for Me, MBA-sita–Profitability Has Never Left You in the Long Term

Agustin Del Rio is Founder and CEO at Gallus Insights, Dallas

When Novak Djokovic was once asked who the better tennis player between Roger Federer and Rafael Nadal on a “neutral” surface was, he humorously retorted, “Which surface is that? Ice?”

This query aptly mirrors the elusive search for ‘normal’ profitability years within the Independent Mortgage Bank sector. What does ‘normal’ even look like in the mortgage industry? The simple answer: it doesn’t exist.

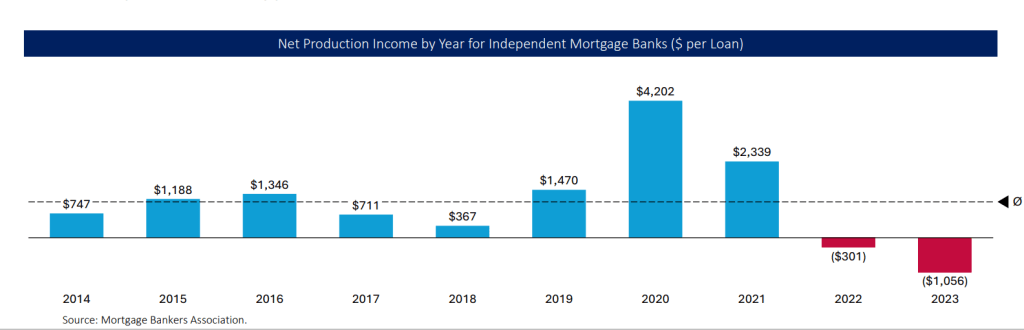

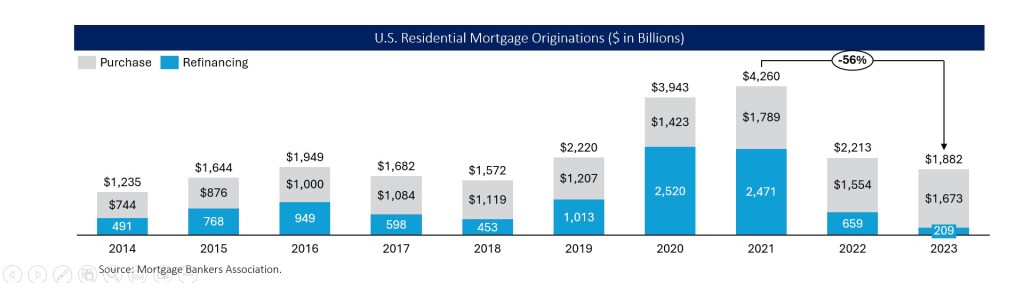

A few days ago, I immersed myself in the comprehensive annual report from the Mortgage Bankers Association. It’s a phenomenal document, brimming with insights into the current state of mortgage finance. As anticipated, the findings for 2023 were quite disheartening. Volume dropped by 15% compared to 2022, which itself had plummeted by an astonishing 48% from 2021. This significant downward trend in industry volume is visually captured in the graph below.

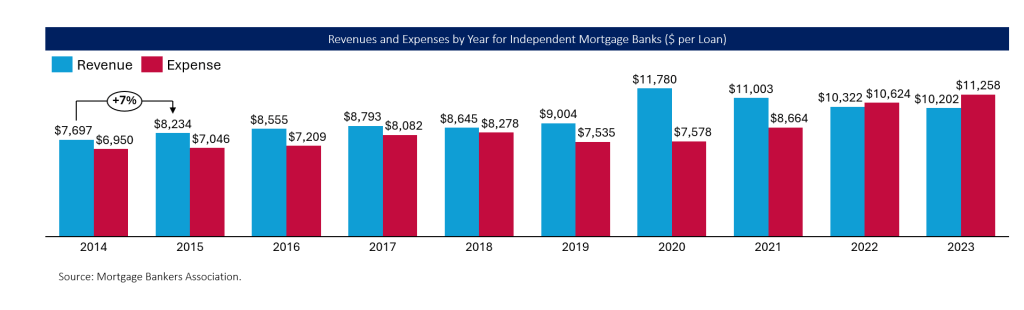

Unfortunately, the bad news doesn’t end there. Since 2020, revenue margins have continuously declined while expenses have trended upwards. Specifically, revenues stood at $10.2k per loan in 2023, down from $11.8k per loan in 2020, and expenses increased to $11.3k per loan in 2023 from $7.6k in 2020. These concerning trends are detailed in the following graph.

As an entrepreneur, I adhere to a simple formula for success: sales, margins, and profits. Comparing the industry’s current trough with its 2020 peak, it feels like we are looking at two entirely different industries. In 2020, the industry boasted $62 billion in profits, while last year, IMBs recorded a $7 billion deficit.

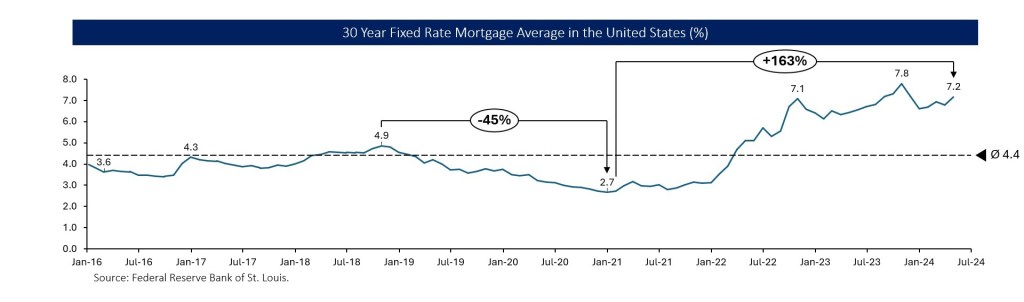

With sales decreasing and diseconomies of scale turning a once robust profit and loss statement into a concerning spectacle, one might wonder: is this the end of mortgage banking as we know it? Is the current business model doomed to fail, or is disruption necessary for survival? My response is resoundingly negative. The industry still possesses considerable excess capacity. The latest figures show an industry-wide employment of 337,000, a 20% decline from the 2021 peak of 420,000. Yet, with demand halved during the same period, further ‘right-sizing’ seems inevitable. Moreover, just as Amazon has gradually transformed retail, disruption takes time to cement itself. The mortgage industry is inherently cyclical, heavily influenced by interest rate fluctuations. The recent downturn can largely be attributed to historic rate declines during the COVID-19 pandemic, followed by a dramatic surge as the Federal Reserve sought to curb inflation. This graph demonstrates the sharp rate movements over the last four years.

While I don’t claim to have a crystal ball, I am confident that the Federal Reserve will stabilize the inflation rate back to around 2%. Additionally, I anticipate another recession (eventually), necessitating rate cuts to mitigate the economic downturn whenever it arises. It’s not a matter of if, but when. When projecting the future profitability of independent mortgage banks, we must look to historical performance for guidance. Since 2014, the profit per loan for IMBs has averaged $1.1k. Is mortgage lending a viable business? On a long-term basis, the answer is unequivocally yes. So, don’t despair, MBA-sita, your profits have never truly left you—they are merely biding their time. Just take a look: