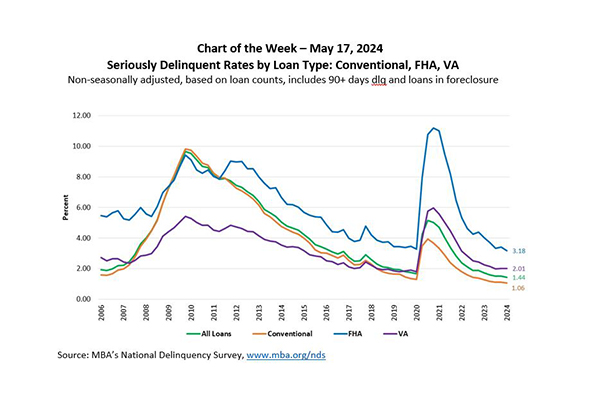

MBA Chart of the Week: Seriously Delinquent Rates by Loan Type

According to the latest results from MBA’s National Delinquency Survey, the overall delinquency rate for mortgage loans on one‐to‐four‐unit residential properties increased slightly to a seasonally adjusted rate of 3.94 percent of all loans outstanding at the end of the first quarter of 2024.

The delinquency rate was up 6 basis points from the fourth quarter of 2023 and up 38 basis points from one year ago. All three loan types saw an increase in delinquencies compared to one year ago, driven by upticks in early and mid-stage delinquencies – those loans more than 30 days but less than 90 days delinquent. The delinquency rate includes loans that are at least one payment past due but does notinclude loans in the process of foreclosure.

In this Chart of the Week, we show the trends in another data point, seriously delinquent loans – only those loans 90 days or more delinquent and loans in the process of foreclosure. For all loan types combined, the seriously delinquent rate reached 1.44 percent, the lowest recorded since the second quarter of 1984 in this NDS series that began in 1979. Meanwhile, the seriously delinquent rate for all three loan types – conventional, FHA and VA – has drifted down since the pandemic peak. In fact, all three loan types recorded lower levels of serious delinquency compared to one year ago, despite conditions such as higher unemployment, lower personal savings, increases in property taxes and insurance, and a run-up in credit card debt and delinquency. Notably, FHA’s seriously delinquent rate in the first quarter of this year was at its lowest point since the second quarter of 1997.

Distressed homeowners appear to be benefiting from available loan workout options and home retention protections, as well as the combination of strong housing demand and accumulated home equity that may enable homeowners to sell their homes well before foreclosure becomes a possibility.

– Marina B Walsh, CMB (mwalsh@mba.org); Joel Kan (jkan@mba.org)