Zillow Finds Concessions Cool as Spring Rental Season Approaches

(Image courtesy of Zillow)

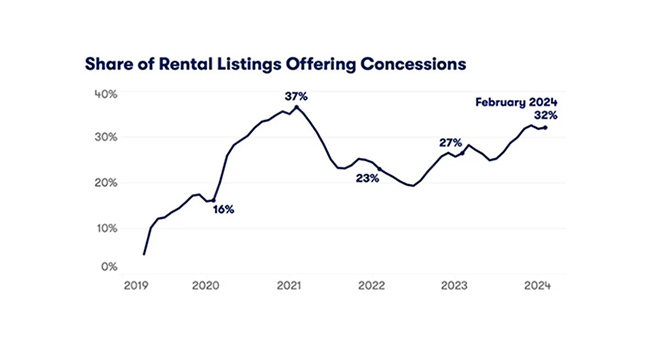

Following a winter that saw nearly a third of rental listings offering tenants tempting concessions such as free months of rent or free parking, Zillow, Seattle, said the share of rentals offering perks may have peaked.

The good news for renters is that the market is friendlier than it was a year ago, with the share of rentals offering a concession rising 5.6 percentage points.

February data shows 32.2% of rental listings on Zillow offered a concession, down slightly from December but up 5.6 percentage points from a year earlier. This marks the slowest annual growth pace since last June. After seven months of consecutive monthly increases to end 2023, the share of rentals offering concessions fell to 31.9% in January.

This means that renters looking to secure a new lease in the upcoming spring or summer may encounter fewer incentives and increased competition if past seasonal trends continue to hold.

“The rental market always ebbs and flows with the seasons, so it’s no shock that we’re seeing concessions start to level off as we move into the warmer months,” said Anushna Prakash, an economic research data scientist at Zillow. “It looks like we’re beginning to see the market balance the ongoing high demand from renters with a competitive environment for property managers and landlords. While concessions are beginning to dip, they are more common than they were a year ago, helped by new buildings that have opened their doors.”

While the expected seasonal shift accounts for the stabilization of concessions, the pace of rent growth and vacancy levels offer deeper insights. Recently, rents haven’t been going up as quickly as they did before the pandemic, and it appears as if supply and demand are starting to balance out. The share of rental housing units that were vacant was at 6.6% in the fourth quarter of 2023, which is slightly higher than the nearly forty-year low seen at the end of 2021. This indicates there are enough eager renters, which is moving the market toward stability.

Metros Leading the Concession Charge

Although there’s a national trend toward stabilization, certain markets continue to lead with high shares of concessions. These metros illuminate the diversity within the rental market, with strategies varying widely across regions to attract tenants.

In nine of the ten metros where the share of rental concessions is highest, rents are growing more slowly than the nationwide 3.5% annual rate, and they are outright falling in Austin. This could mean there are more apartments available than there are people looking to rent them, the report noted.

Alternatively, areas where there are fewer of these kinds of deals available, such as Providence, R.I. (12.3% of rentals offered concessions in February), Hartford, Conn. (16.3%), and Cincinnati, Ohio (18.9%), are seeing some of the fastest rent increases. In Providence, typical rents have jumped by 8.1% since last year. Hartford and Cincinnati both saw rents increase by 6.4%.