CBRE: North American Data Center Pricing, Supply Remain Strong in Primary Markets

(Image courtesy of CBRE; Breakout image courtesy of Brett Sayles/Pexels.com)

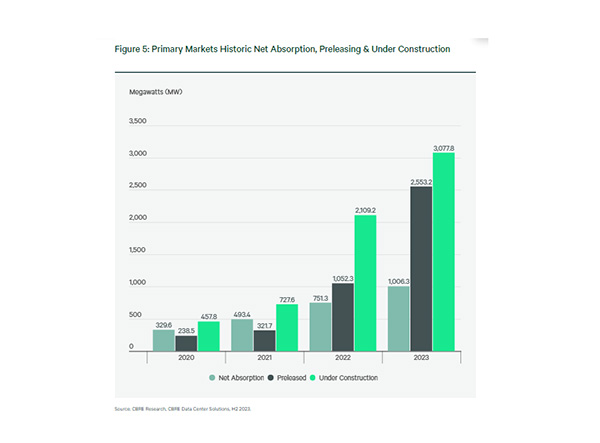

CBRE, Dallas, found the primary market supply for data centers in North America grew 26% year-over-year in 2023.

That puts the supply in those markets at 5,174.1 megawatts.

Additionally, an all-time high of 3,077.8 megawatts were under construction in primary markets, up 46% year-over-year.

Preleasing activity is also strong, with 2,553.1 megawatts preleased–or 83% of the supply under construction.

Vacancy rates remain low, at 3.7%.

The average monthly asking rate for a 250- to 500-kw requirement across primary wholesale colocation markets increased 18.6% year-over-year, to a record $163.44 per kW/month.

“The U.S. data center market saw the largest pricing increase of all commercial real estate assets last year, which is a testament to the market’s resiliency and impact of robust requirements for available power,” said Pat Lynch, Executive Managing Director for CBRE’s Data Centers Solutions. “There is no sign that demand will slow down as the economy becomes more digital and artificial intelligence expands to new sectors. More operators and developers are prioritizing decisions that allow them to provide high value, technologically advanced spaces, which will help to drive future demand.”