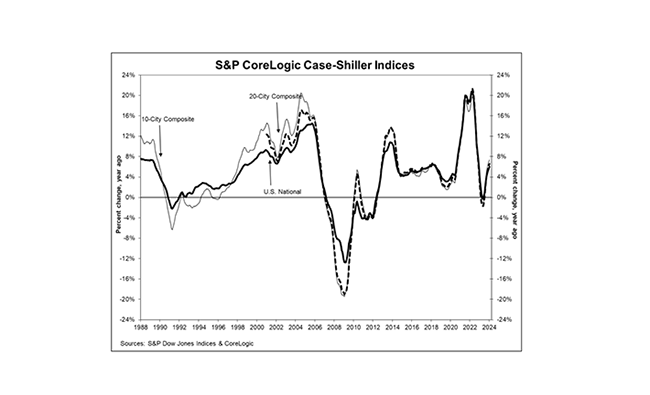

S&P CoreLogic Case-Shiller Report Finds 6.0% Annual Home Price Growth

(Illustration courtesy of S&P CoreLogic Case-Shiller Home Price Index report)

U.S. house prices continue to increase, with the S&P CoreLogic Case-Shiller U.S. National Home Price Index reporting a 6.0% annual gain in January, up from 5.6% in December.

For the second consecutive month, all cities reported increases in annual prices, the report said.

“Homeowners most likely saw healthy gains in the last year, no matter what city you were in, or if it was in an expensive or inexpensive neighborhood,” said Brian Luke, Head of Commodities, Real & Digital Assets at S&P DJI, which publishes the monthly report. “No matter which way you slice it, the index performance closely resembled the broad market.”

Measured from its June 2006 peak, the national index is up 68.2% from its July 2006 peak, the Case-Shiller report said.

CoreLogic Chief Economist Selma Hepp said elevated mortgage rates froze housing market activity over the winter but noted an “unthawing” is in sight as more for-sale inventory means more opportunities for potential buyers across the country. “With spring’s arrival, home prices are likely to show a seasonal uptick, although the annual acceleration in gains will slow compared with the strong 2023 spring,” she said. “Nevertheless, more inventory is a welcome development and suggests that some normalization in the U.S. housing market lies ahead.”

A&D Mortgage CEO Max Slyusarchuk predicted home price growth will likely not surge going into the Spring home buying season, as home sales are fairly stagnant at this moment. “We do believe rates will begin to drop in the second half of the year, and that will help pick up home sales, which will be buoyed by stable home values,” he said.