MBA Pre-Recorded Webinar on NAR Commission Lawsuit Settlement

MBA recently released a pre-recorded webinar with Pete Mills, SVP of Residential Policy and Strategic Industry Engagement, Justin Wiseman, VP of Regulatory Affairs and Managing Regulatory Counsel and Alisha Sears, Director and Regulatory Counsel discussing the NAR Commission Settlement.

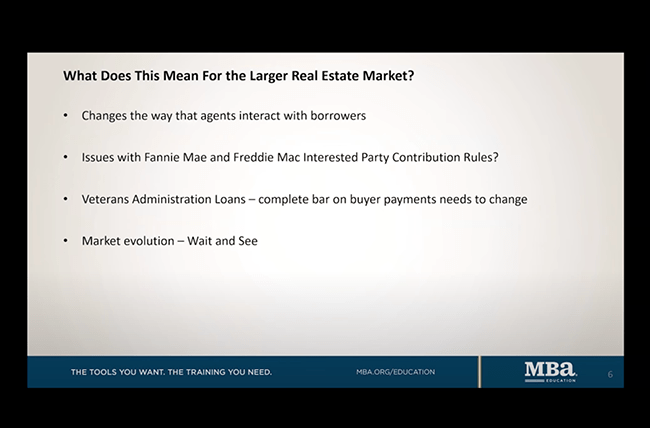

The webinar covers the scope of the settlement; the changes in real estate agent compensation practice it requires; the potential changes in how buyers, sellers and their respective agents contract and get compensated; and the possible implications for the financing transaction and how lenders engage with their Realtor® referral sources.

Go deeper: Earlier this month, the National Association of Realtors (NAR) agreed to settle a series of lawsuits by paying $418 million in damages and eliminating its rules on “cooperative” commissions. If approved, changes will likely go into effect mid-July 2024. The impact on the home sales process and the mortgage industry is likely to evolve, with new approaches to the negotiation and payment of buyer agent commissions.

As new business models emerge in the real estate brokerage space, MBA’s focus will be on helping our members adapt to these developments, and ensuring that the changes adhere to core principles that ensure buyers that need representation have access to it, that buyers can negotiate over who pays for that representation, and the new models do not disrupt the home financing process and make the experience worse for homebuyers and home sellers.

Read MBA’s three-page summary of “key takeaways” from the settlement, and the latest blog post from MBA’s President and CEO Bob Broeksmit, CMB.

What’s next: MBA encourages members to help us track and understand how the market is evolving so that we can hold market participants (and regulators, if necessary) to core principles that make sense for sellers, buyers, and lenders. MBA has been in discussions with NAR, the GSEs, Federal Housing Finance Agency (FHFA), Federal Housing Administration (FHA) and the Department of Veterans Affairs (VA) to identify the likely permutations and the best way forward.

For more information, contact Pete Mills at (202) 557-2878 or Justin Wiseman at (202) 557- 2854.