CoreLogic: Delinquencies Nearly Flat in December

(Image courtesy of CoreLogic)

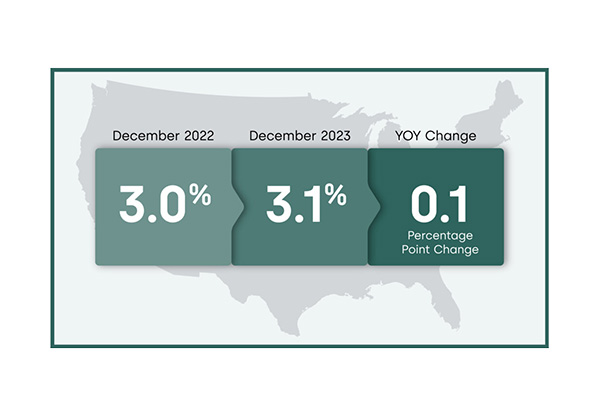

CoreLogic, Irvine, Calif., reported the national overall mortgage delinquency rate was 3.1% in December, up by 0.1 percentage point year-over-year from December 2022 and 0.2 percentage point from November.

Despite the slight increase, the rate of delinquencies remains low by historical standards.

“Early-stage mortgage delinquency rates increased in December 2023 from one year earlier but remained near historic lows,” said Molly Boesel, Principal Economist for CoreLogic. “There were offsetting declines of home loans that were six months or more past due, which led to a drop in the serious delinquency rate.”

“However, other types of consumer credit showed increases in serious delinquency rates at the end of 2023,” Boesel continued. “The Federal Reserve reports that the number of credit-card and automobile-loan transitions moving into serious delinquency were above pre-pandemic levels, which could be a signal of increased financial stress for some Americans.”

By stages of delinquency:

Early-stage delinquencies (defined as 30 to 59 days past due) were 1.6%, up from 1.4% in December 2022.

Adverse delinquencies (defined as 60 to 89 days past due) were 0.5%, up from 0.4% in December 2022.

Serious delinquencies (defined 90 days or most past due, including loans in foreclosure) were 1%, down from 1.2% in December 2022.

The foreclosure inventory rate was 0.3%, flat from December 2022.

The transition rate–or the share of mortgages that transitioned from current to 30 days past due–was 0.9%, up from December 2022.

Seventeen states saw mortgage delinquency rates increase year-over-year. The largest gains were in Louisiana (up by 0.4 percentage point) and Hawaii (up by 0.3 percentage point.)