‘Home Flipping’ Plummets as Profits Slump

(Illustration courtesy of ATTOM)

Home flipping fell nearly 30% in 2023 compared to the year before, according to ATTOM, Irvine, Calif.

The ATTOM year-end 2023 U.S. Home Flipping Report said 308,922 single-family homes and condos in the United States were flipped last year, down 29.3% from 436,807 in 2022 and the largest annual drop since 2008.

“In 2023, the landscape for home flipping across the U.S. became increasingly challenging,” ATTOM CEO Rob Barber said. “Whether the overall market has soared or seen just modest gains in recent years, investors have missed out on the action.”

Barber added that the sharp decline in the number of home flips likely reflected a combination of a tight supply of homes for sale as well as dwindling returns. “Either way, it will take some significant reworking of the financials for home flipping fortunes to turn back around,” he said.

The report also revealed that as the number of homes flipped by investors declined, so did flips as a portion of all home sales, from 8.6% in 2022 to 8.1% last year.

In another sign of down times for the home-flipping industry, profits and profit margins also sank on quick “buy-renovate-and-resell” projects. Gross profits on typical home flips in 2023 dropped to $66,000 nationwide (the difference between the median sales price and the median amount originally paid by investors). That was down from $70,100 in 2022 and translated into just a 27.5% return on investment compared to the original acquisition price.

The latest nationwide ROI (before accounting for mortgage interest, property taxes, renovation expenses and other holding costs) was down from 28.1% in 2022 and 35.7% in 2021, ATTOM said; the worst level since 2007.

Investors saw their profit margins decrease for the sixth time in the past seven years as the median price of the homes they flipped dipped slightly faster than the median price they had paid to purchase properties – 4.4% versus 4%.

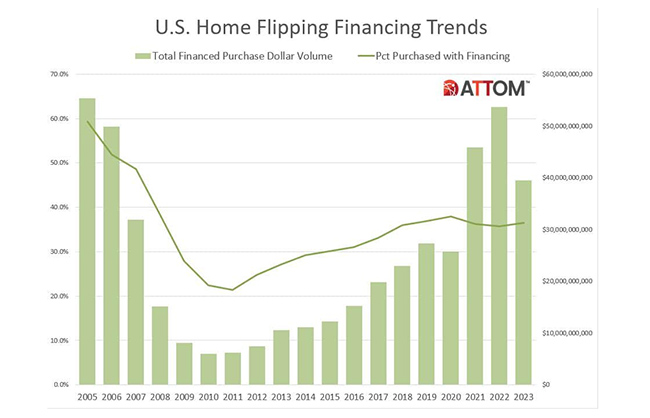

Nationally, the percentage of flipped homes originally purchased by investors with financing increased in 2023 to 36.5%, up from 35.7% in 2022 and from 36.2% in 2021, ATTOM said. Meanwhile, 63.5% of homes flipped in 2023 were originally bought with cash only, down from 64.3% in 2022 and from 63.8% two years earlier.