Fannie Mae: Higher Rate Forecast Leads to Declining Home Sales Expectations

(Illustration courtesy of Fannie Mae)

February’s mortgage rate increase led to a modest downgrade to expectations for total home sales and mortgage originations this year, according to Fannie Mae, Washington, D.C.

The Fannie Mae Economic and Strategic Research Group recently released its March 2024 commentary. The organization now expects the 30-year fixed mortgage rate to end the year at 6.4 percent, up from the 5.9 percent predicted in last month’s forecast.

“Strong headline jobs numbers and hotter-than-expected inflation data had led financial markets to price in a less aggressive rate-cutting path by the Federal Reserve, and while the ESR Group notes that labor market indicators are mixed and disinflation will likely resume, it also believes that recent data are unlikely to provide the Fed with the ‘greater confidence’ it needs to begin easing monetary policy in the near term,” the report said. But the Fannie Mae ESR Group noted it expects existing home sales will trend upward in 2024 due in part to increased activity by households likely needing to move due to life events – and who are thus less sensitive to the interest rate lock-in effect.

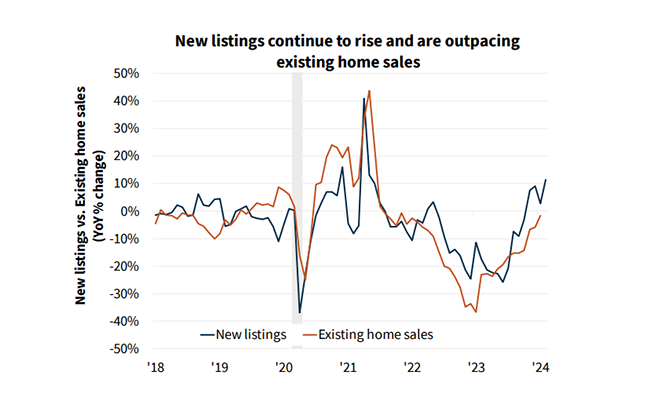

The ESR Group cited the recent trend upward in new home listings as well as comparative strength in the latest reading of the ‘good time to sell’ component of the Fannie Mae Home Purchase Sentiment Index as evidence that housing market activity is likely to continue its gradual thaw in the months and quarters ahead.

“The housing market is likely to continue to face the dual affordability constraints of high home prices and elevated interest rates in 2024,” said Doug Duncan, Fannie Mae senior vice president and chief economist. “Hotter-than-expected inflation data and strong payroll numbers are likely to apply more upward pressure to mortgage rates this year than we’d previously forecast, as markets continue to evolve their expectations of future monetary policy.”

Duncan noted he does not expect a dramatic surge in the supply of homes for sale but does anticipate an increase in the level of market transactions compared to last year, “even if mortgage rates remain elevated.”