Mark Dangelo: In an Age of Everything AI, ‘Superman, Where are You Now?’

As AI accelerates along an exponential curve of features and intelligence, there are hidden risks and opportunities that require “fabrics” of solutions strong enough to deliver requirements, but also robustly adaptable to unanticipated consequences. Lacking the ability to obtain superpowers inside a phone booth, mortgage and BFSI leaders need to change their approaches, organization, and staff all at once.

In an age of AI, any idea of discussing how to capitalize on innovation, technology, and data advancements can only seemingly be accomplished with the deployment of solutions that contain cloud computing, neural networks, federated learning, and even emerging solutions that include large action modules (LAM’s, e.g., Rabbit 1.0). For mortgage and bank, financial services and insurance (BFSI) leaders it appears that innovation and technological advancements are like politics—you are either for one or against another—no middle ground.

Headlines discuss the early piloting successes, showcase the revenue potential, and focus on efficiency and quality of delivery—all good. Yet, to move beyond early use cases and stories, the innovative singularity mindset requires upskilling, alignment, and transformation beyond the threads of AI.

Even within industry and academic circles, the focus of singularity on a product or research creates advancements, but how can these rapid-cycle, transitional capabilities be cost-effectively deployed? Scaled? How do all the pieces, all the options, all the choices fit together beyond today’s use cases? The industry witnessed the start of interconnected solutions and disciplines back in 2019 with the designs of data meshes, and more importantly, with the M&A consolidations across software and Fintech vendors spanning origination, servicing, and securitization.

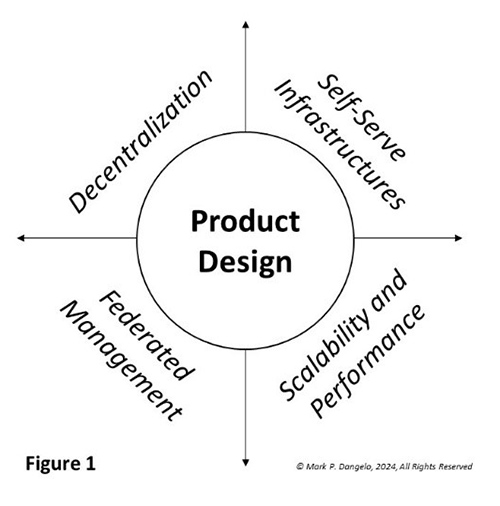

To make these Age of AI advancements payoff beyond their early 2023-2024 pilots and as part of a robust, interconnected, and adaptable business as usual (BAU) series of solutions, leadership must deliver against a growing fabric of complex requirements, specialized capabilities, and risk attributed tradeoffs (represented in Figures 1 and 2 below). Herein is the shift that is facing leaders—do they apply strategies and measures of prior cycles to an Age of AI, or are there next-gen fabrics of design and architecture, which need to be created across vendors, academia, and industry?

What are the basic elements of an adaptable industry fabric?

What constitutes a fabric that can incorporate vast requirements, varied use cases, and hypercycle innovative advancements, which are upending budgets, profitability, and consumer behaviors? An industry innovation fabric is analogous to how garments are weaved and created. Like garment fabric, the weave for an executable fabric is comprised of both horizontal and vertical threads.

There are five key macro dimensions of a mortgage / BFSI fabric design includes (see Figure 1):

Decentralization: the ownership of technologies, the data, and even the organizational contributions are no longer commonly centralized. The industry business models have changed, the value and longevity of information has evolved, and the ability to integrate disparate platform solutions are not optional.

Self-Serve Infrastructures: With the explosion of cloud capabilities (e.g., software, platforms, data, security), the provisioning dynamics and the cost of implementation have shifted in favor of iterations and time-to-market. The models of IT returns and data risks require a shift of skills coupled with layered, complex features demanding building block designs and application componentization that can be created, merged, retired in sync with market forces.

Federated Management: The diversity of data, applications, processes, and technologies within and across industry segments requires a complex web of active oversight and governance. Federated management designs which include integration of data sovereignty and (predictive) regulatory compliance, must be aligned with decentralized solutions and self-service architectures.

Product Designs: The delivery of integrated components, technologies, data, and innovations requires a product design mindset and architecture. Group across domain subtypes (e.g., origination, customer, servicing, securitization), fabrics include the complex array of functionality into reusable components that can be stacked much like a bill-of-materials inventory or data entity supertype / subtype logical model. These products create block elements thereby delivering cost-effective, auditable, and manageable solutions including open-source API’s.

Scalability and Performance: With building blocks and self-serve architectures, organizations must consider the breakpoints when deploying product designs and federated governance across data, technology, and organizational management. Many emerging solutions are not linear in their resource consumption and when coupled with demands for quality, consistency, auditability, and flexibility, create requirements that are no longer single discipline focused (e.g., AWS, warehousing, domain apps, artificial organizational boundaries).

In general, by deploying the Figure 1 framework mortgage / BFSI executives can create a principle-based series of adaptable designs (i.e., modern-age Zachman architectures) that match the speed of innovation. These fabric designs deliver consistency across exploding decentralized solutions, varied data sources, and with quality of service that provides consistency and quality.

However, to knit together these general elements while managing existing priorities, industry leaders cannot blindly accept that vendor, industry, or academia incremental advancements will seamlessly work in concert—they won’t. Creating a fabric will not deliver superpowers to the organization—just like the costume did not create Superman. Design is the first step—iterative and repetitive actions create reality.

Given all the priorities, how can fabrics be iteratively developed?

As illustrated in Figure 1, adaptable, innovative fabric approaches for mortgage / BSFI center around product design cross-discipline capabilities. Utilizing common integration and delivery principles, enterprise leaders can create collaboration across traditionally fragmented software applications, silos of data warehouses and lakes, and down market sharing of immutable data that shortens production timeframes, reduces costs, and improves margins on commodity products and services.

Moreover, with the rise of open-source applications and banking-as-a-service (BaaS), the demands on IT and BP operations requires a fabric of design that provides the crosslinked capabilities once sought from traditional industry and point-based Fintech improvements. The principles of design move into sprint-driven action with the architectural implementations of:

Modularity / Containerization: The creation of a product design with encased functionality defining set inputs, outputs, scale, use case, and domain relevancy.

Standardization of Data and Interfaces: Using industry (e.g., MISMO) and cross-platform standards, organizations can reduce the burden of one-off development and maintenance. This element delivers the ability to create robust and adaptable technology stacks with interoperability across teams, divisions, and even competitors.

Data Isolation / Data-as-a-Product (DaaP): Building on the above within a product mindset, data elements, fields, extractions, metadata, and so on move organizational importance away from system ideation and into next-gen, data ideation. Meaning rather than address data management system by system, dealing with regulatory compliance singularly on a product line, or even replicating standardized data for future action, the ability of the organization to isolate and recreate all the business rules acting on instances or elements ties to the system-of-record.

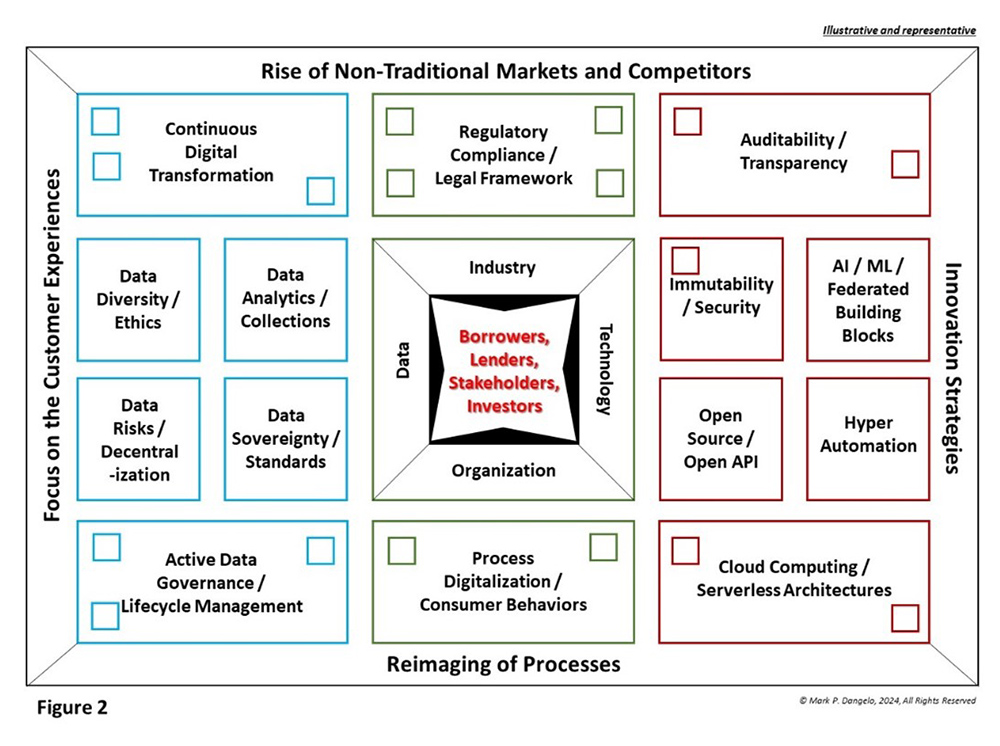

Context and Virtualization Tools: To take advantages of rising computing intelligence and modularity—data meshes, integrated AI chipsets, federated learning, hyper automation, et al—enterprises need to assemble (as continues to be done with metadata across structured and unstructured data), fabrics which can weave complex and often point-based capabilities into a mosaic across four dimensions. Those dimensions (shown below, e.g., Industry, Data, Technology, and Organization) filter and provide the context for all discrete and granular fabric components and links scare skills and speed of business requirements.

An example of moving the industry, vendor, and academia ideas into a fabric design for BFSI / mortgage is shown in Figure 2. It is a simple, illustrative representation worth 10,000 words.

Shown conceptually and sparing the vast detail underneath Figure 2 is a consistent, observable, and adaptable series of interoperable components already deployed in multiple forms across industry applications and infrastructures. The fabric unlocks the investments and efforts already viewed as a sunk cost, thereby leveraging best-practices borrowed from existing implementations.

By normalizing and containerizing the common elements of technology, applications, and data, the industry can capitalize on its two most important constituents—customers and its internal knowledgebases—the use of industry fabrics will prove a robust approach to tackle change and vast demands in an Age of AI (red Superman cape not required).

In summary, BFSI and mortgage leaders traditionally believed that their industry was unique and required designs and implementations that only could have been created internally. Yet, the last 15 years have broken those expectations and realities—AI has introduced an entirely new plane of capabilities and competition. Advances in technologies and data are intersecting with critical pressures from industry and organizations.

In summary, do industry leaders apply the familiar to the unfamiliar Age of AI solutions? Will this “lift-and-shift” outsourcing mindset work? Or will, as these data-driven business ecosystems evolve, the Age of AI require interconnected designs, architectures, and implementation strategies that have a proven track record (i.e., use of fabric approaches), but are not widespread within the mortgage / BFSI IT leadership?

Mortgage and BFSI leadership might be tempted to view the ideas of industry, vendor, and academia inclusion fabrics (sometimes referred to in technical circles as multimodality architectures) for industry use optional, too complex, or even delusional. Yet, these fabrics have been out in the “wild” and are growing advocates and solution capabilities. To compete in the future requires multi-disciplinary use of technologies, leverage and reuse of data, and an investment in organizational skills and capabilities—all unfamiliar, yet manageable if new methods and approaches (i.e., AI “life” forms) are actively applied.

Not everyone can be JP Morgan regarding their IT budgets (recent numbers estimate that it has nearly 70,000 IT professionals backed yearly budgets exceeding $15 billion —and growing). If you want to compete in an Age of AI against well-funded competitors, staying the course may prove to be Kryptonite to sustainability. The creation and deployment of fabrics offers a lead shield against destruction—perhaps Superman should consider this a new superpower?