Homeowners Average Almost $18,000 Per Year on Non-Mortgage Expenses

(Image courtesy of Real Estate Witch; Breakout image courtesy of Ksenia Chernaya/pexels.com)

The average homeowner spends $17,958 on non-mortgage expenses, a recent study found, listing categories such as maintenance, improvements, utilities, property taxes and insurance.

The study was conducted by an online publication, Real Estate Witch, owned by Clever Real Estate, St. Louis, Mo.

Homeowners, however, estimate that they only spend $10,094 a year, showing an expectation gap.

Additionally, 23% of homeowners spend more than 30% of their income on their home on top of mortgage payments.

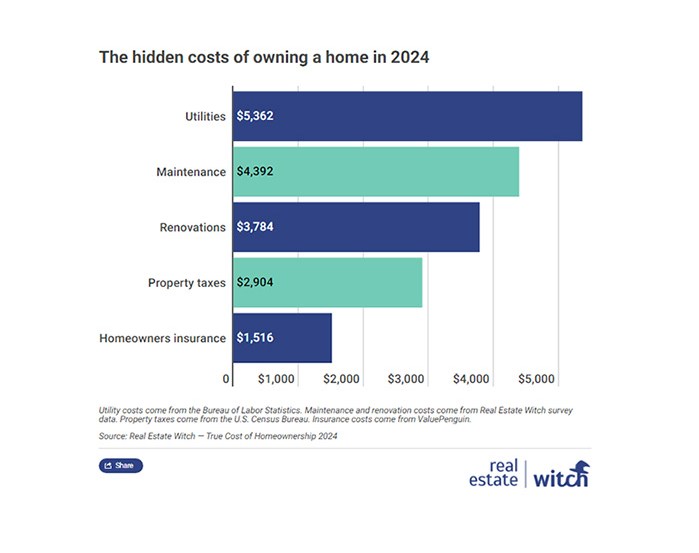

Broken down by categories, the study found the average homeowner spends:

• $4,392 on maintenance and repairs

• $3,784 on renovations and improvements

• $5,362 on utilities

• $2,904 on property taxes

• $1,516 on homeowners insurance

Of those items, 29% of homeowners say they find property taxes to be the single most surprising cost of owning their home, followed by maintenance at 24%.

Over the course of a 30-year mortgage, these expenses would translate to more than $538,740 in additional expenses beyond a mortgage.

Overall, 88% of respondents said the true cost of owning a home is more than they expected. Thirty-six percent said their home has negatively affected their finances, and 23% said it affected their mental health.

About 69% report taking risks or making personal sacrifices to afford additional homeownership expenses.

Repairs and renovations also require time spent–homeowners report an average of 588 hours each year working on home upkeep.

About 35% of respondents say they’d be willing to pay up to $100,000 more for a house that requires little to no upkeep.