MCT: 7% Increase in Mortgage Lock Volume in May

(Image courtesy of MCT; Breakout image courtesy of Charlotte May/pexels.com)

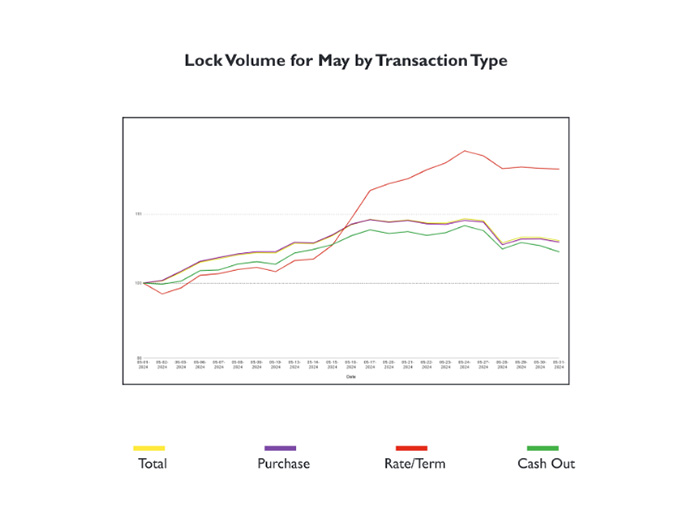

Mortgage Capital Trading Inc., San Diego, announced an increase of 6.78% in mortgage lock volume in May compared with the previous month.

The purchase index was up 6.54% from April.

In terms of refinances, the rate/term index was up 18.21%. The cash out refinance index was up 4.99%.

Year-over-year, the total index is up 19.84%.

The purchase index is up 21.72% year-over-year. The rate/term refinance index is up 50.61% year-over-year. However, the cash out refinance index is down 11.94% year-over-year.

MCT noted amid these results, economic indicators in May presented a mixed bag, including a Consumer Price Index that aligned with predictions and a jobs report that significantly exceeded forecasts.

“The next couple of months will be key from a data standpoint as the Federal Reserve looks for a trend of inflation heading towards the goal of 2%. Considering the Nonfarm Payroll number that just came out, setting a trend is going to take more time,” said Andrew Rhodes, Senior Director and Head of Trading at MCT. “We’re looking ahead to the May CPI print to see how the Fed is going to interpret both data points. Even with CPI coming in around expectation, the jobs number could likely push the Fed to further delay their rate cuts.”