ICE First Look: Calendar-Driven Spike in Delinquencies in June; Foreclosures Remain Historically Low

(Illustration courtesy of Intercontinental Exchange)

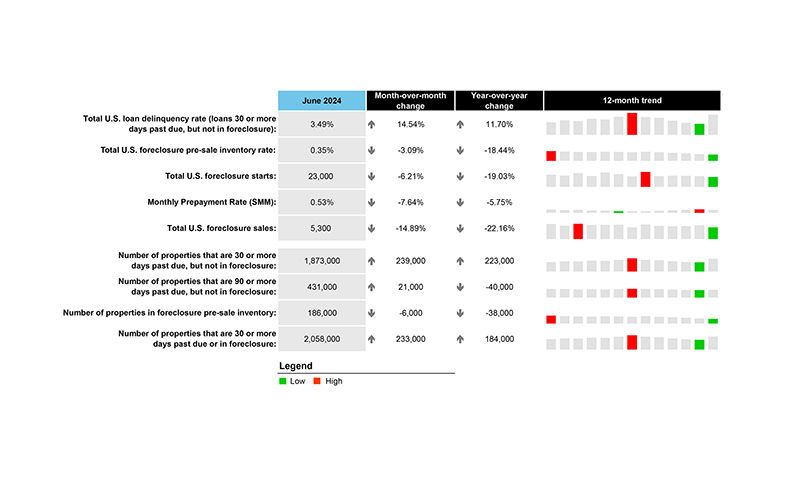

Coming off a near-record low in May–and with June ending on a Sunday–the national delinquency rate increased to 3.49%, its second-highest level in 18 months, according to Intercontinental Exchange.

In its “First Look” report examining June mortgage performance data, ICE noted Sunday month-ends often lead to sharp, but typically temporary, spikes in delinquent mortgages, as payments made on the last day of a given month are not processed until the next.

“As such, June saw a 19.6% increase in the number of borrowers a single payment past due – the highest inflow since May 2020 – while 60-day delinquencies rose 11.8% to a five-month high,” the report said.

Though up more than 5% from May, loans 90 or more days past due but not in active foreclosure were still down 8.5% year over year and 10.1% below pre-pandemic levels, the report said. Foreclosure starts also declined in June, pushing active foreclosure inventory to its lowest point since the end of COVID-era moratoriums, now 34% below pre-pandemic levels.

ICE calculated there were 5,300 foreclosure sales nationally in June, a 14.9% month-over-month decrease to their lowest level since February 2022 and still well below pre-pandemic norms “Prepayments eased 7.6% from May, breaking a six-month streak of increasing activity as we near the typical seasonal peak of home sales with persistent affordability and rate constraints,” ICE said.