Fannie Mae: Consumers Want to Buy Homes, But are Pessimistic

(Image courtesy of Fannie Mae; Breakout image courtesy of SevenStorm JUHASZIMRUS/pexels.com)

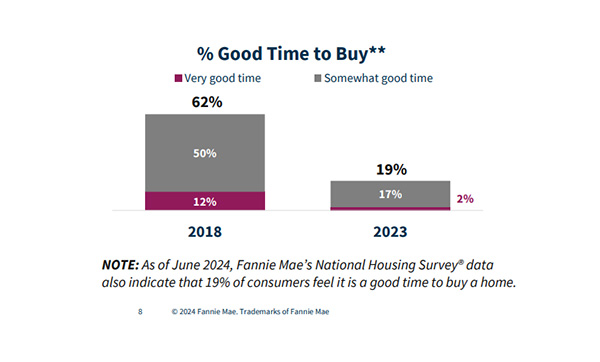

Fannie Mae released the latest version of its Consumer Mortgage Understanding Study, finding that consumers are pessimistic about homebuying conditions–with only 19% saying now is a good time to purchase a home. However, 92% still report owning a home is important to them.

Fannie Mae has conducted this periodic survey in 2015, 2018 and 2023.

Despite the pessimism, 74% of those surveyed say they will purchase a home on their next move, including 43% of current renters. One-fourth are actively looking to purchase in the next three years. Ninety-five percent would prefer to live in a home they own over one they rent.

In general, consumers are feeling significantly more concerned about their financial situations than in 2018 and 2023. Twenty-seven percent answered “always” or “often” to “my finances control my life,” and 35% answered affirmatively on “I am concerned that the money I have or will save won’t last.”

Questions about consumers’ understanding of the homebuying process reveal mixed results. Only 32% are familiar with low down-payment programs, but that’s up significantly from 23% in 2018. And, only 40% are aware of counseling services to help during the mortgage process.

Moreover, 90% of consumers overstate or don’t know the minimum down payment for a typical mortgage. One-third do not know or significantly misestimate the minimum credit score required.

Forty percent don’t know what percentage of a monthly income lenders prefer not to exceed for mortgage payments.

The top reason consumers believe they would have a hard time getting a mortgage is insufficient income to afford monthly mortgage payments.

About 45% say they would currently feel confident going through the mortgage process–fairly flat with 2018 levels–and 68% report they would be somewhat confident having a conversation with a lender.