Mark Dangelo on Leadership: The Quiet Arrival of ‘Adapt or Die’

Click here to view this article in AI-generated video.

Two years ago, sponsored by the MBA and presented at their Annual Convention, I released “Adapt or Die: The Mortgage Technology Ecosystem Reimaged for the Digital Consumer.” It was a call-to-action for industry leaders to reengineer their solutions, processes, and most importantly, their data.

Today, the mortgage markets continue to languish due to high interest rates, lack of supply, changing consumer behaviors, and perhaps a hope for nostalgia.

Regardless of the rationale, has the time arrived for the industry to make a quantum shift in who, what, why, and how consumers participate in a digital, AI enabled mortgage industry? Indeed, business leaders point to regulations as a primary inhibitor to change. Others point to a lack of capital and skills necessary to transform. A third inhibitor resides with traditional systems, processes, and the vendors that dominate system functionality. However, are these commonly accepted transformational principles sufficient after three years of declines and marginal increases projected in 2025-2026?

Recognizing the Drivers of Change

There is a fundamental mindset that inhibits the recognition and solution acceptance of the “investments” that need to be made in the face of declining to flat markets. Traditional mortgage markets were segmented, distinct roles and data depending on where your business participated. It was a process and compliance mindset.

As is 2022 and increasingly moving forward, this siloed mindset offers little beyond commodity products and services regardless of the vendor updates and positioning. To participate and profit from emerging housing markets requires a different mindset and approach. It requires a data mindset that transcends individual products and services.

The future industry markets are built on a foundation of shared data regardless of origination, servicing, or even securitization. This is not an intuitive transformational approach. It requires new investment models. It demands new skills—especially when considering data-driven, small design AI (artificial intelligence). And most importantly, changes to apps, to infrastructure, to cloud services, requires the identification of different business and technology drivers. A few of these are presented below:

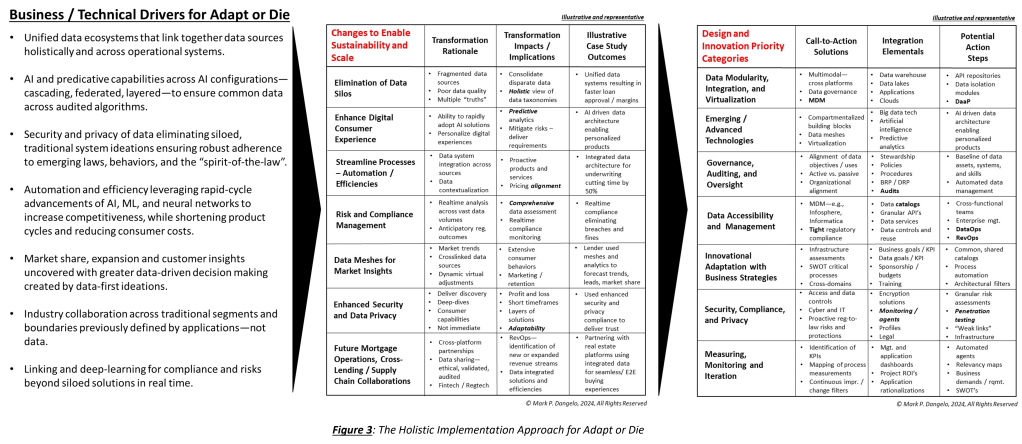

Unified data ecosystems that link together data sources holistically and across operational systems (e.g., LOS’s, underwriting, valuations, insurance).

AI and complex, predicative capabilities across AI configurations—cascading, federated, layered—to ensure common data across audited algorithms.

Security and privacy of data eliminating siloed, traditional system ideations ensuring robust adherence to emerging laws, behaviors, and the “spirit-of-the-law”.

Automation and efficiency leveraging rapid-cycle advancements of AI, ML, and neural networks to increase competitiveness, while shortening product cycles and reducing consumer costs.

Market share, expansion and customer insights uncovered with greater data-driven decision making created by data-first ideations.

Industry collaboration across traditional segments and boundaries previously defined by applications—not data.

Linking and deep learning for compliance and risks beyond siloed solutions in real time.

What is evident and frustrating for traditional industry firms and their vendors is the change of topics, focus, design, and importance with across the explosion of data ideated industry offerings and familiar application thinking. Pushed into secondary discussions (but still important) are processes as part of developing discrete data solutions, which have a longer life-cycle when compared to rapid changes in cloud-as-a-service (CaaS) variations (e.g., SaaS, BaaS, IaaS) and innovation driven customer experience offerings (e.g., mobile).

As mortgage industry providers struggle with the “adapt or die” challenges in front of them, what are their choices? Are there specific benefits and targeted efforts that should be immediately addressed? How can this be done without shutting down business and starting over?

Placing the Drivers into Context—Transformation

To move beyond the shocks of different approaches discussed above, there is another series of technology that is becoming “THE” rationale for moving beyond application thinking and into data-decisioning to survive the market conditions—AI. While the current focus is on Gen AI solutions—e.g., chatbots, agents, training, research—the explosion of interest and venture backed options provides vast data-driven applications that will dominate the mortgage industry for the next decade.

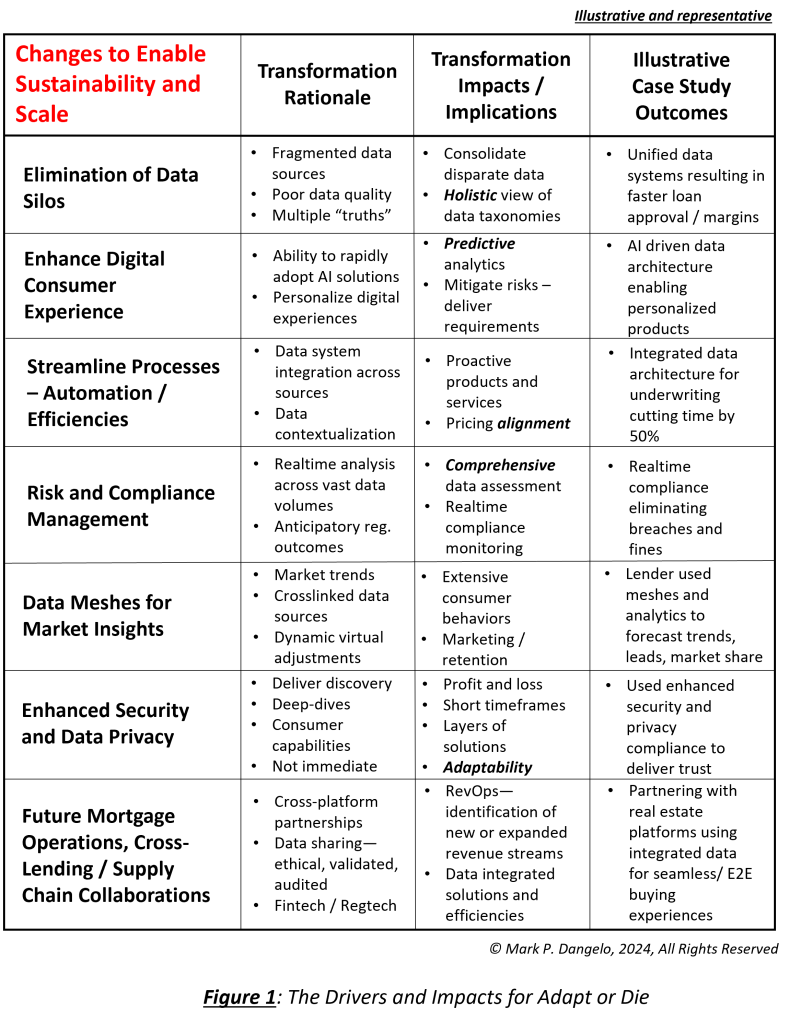

Therefore, for an industry undergoing vast changes in composition, behaviors, and technologies, the roadmaps to change can be frustrating. Also evident as AI explodes with options is that these “intelligent” technologies are just the enablers—not the end states. For organizations to sustain adaptable transformations deploying AI, the following table (see Figure 1) provides an illustration of tailorable actions and case study representations from early adopters of the “Adapt or Die.”.

The table is part one for organizations looking to move beyond the idea of application encased data silos, which continues to dominate process provisioning.

If the above table is reviewed in detail, it highlights the critical areas of transformation that must be undertaken with their rationale and implications tied to the business and technical drivers previously identified. These rows of focus should then be broken down into familiar call-to-action projects that will provide the foundation for efficiencies and scale as the next mortgage cycle emerges in 2025-2026.

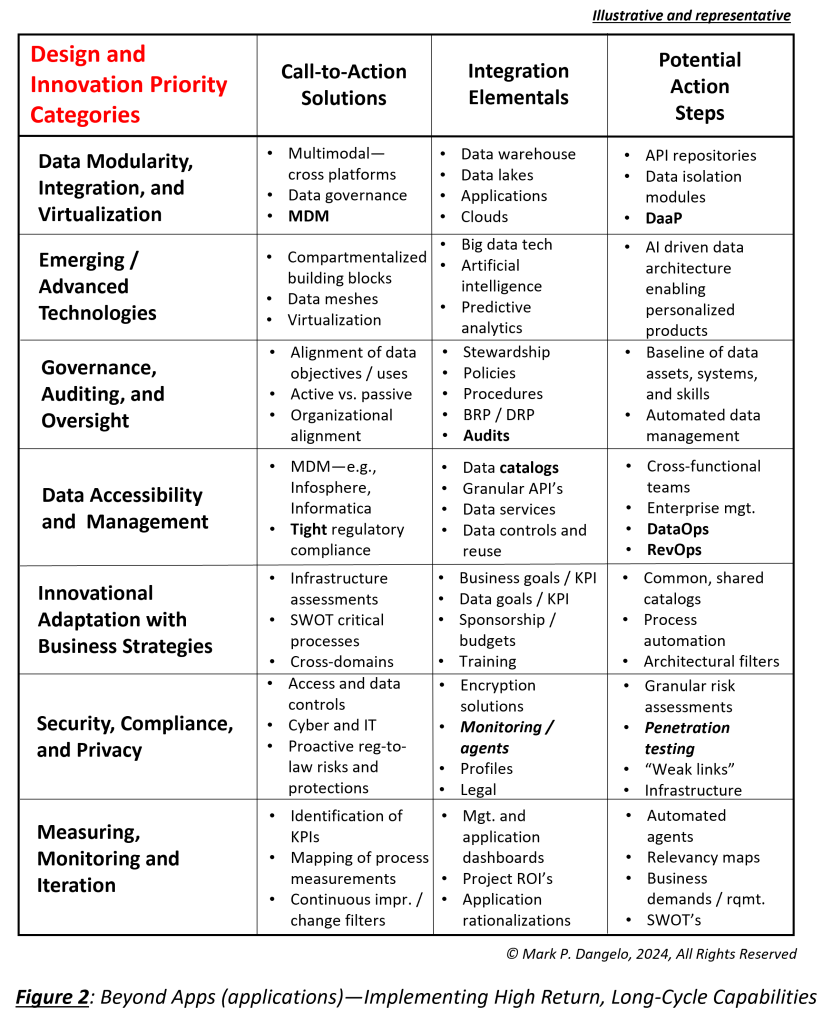

In Figure 2 and tied to the reimaging of the industry paper released in 2022, we can approach the strategy and objectives of change using achievable building block projects that are tied together thereby leveraging traditional applications with a cohesive, stable design that captures innovation without costly rework.

To make the most sense out of the detailed approach contained within Figure 1 and 2, the following illustration assembles the framework into a holistic approach. Starting at the left and working to the right, the drivers influence the architecture, which in turn impacts the design and innovation programs tied to cross-application implementation.

What has transpired since “Adapt or Die” was released, has been an industry undergoing a near 50% contraction. What has transpired since late-2022 was the explosion of AI capabilities and the demand for data-driven management solutions. What has culminated in this last boom-to-bust cycle is that the seeds for change for comprehensive digitally native, straight-through process redesign is shouting for adoption. There is no going back to previous cycles with consumers, with technology offerings, and most importantly with data and standards.

After decades of growing consumer fees and automated paper-based processes, does the mortgage industry—origination, servicing, and securitization—really accept that the next “boom” cycle will require the incremental, traditional approaches pieced together with siloed Fintech and Regtech capabilities? What we started discussing in 2022 and now emphasized by new technologies and data is that incremental, piece-by-piece solution approaches are dying.

The burning platform from 2022 in “Adapt or Die: The Mortgage Technology Ecosystem Reimaged for the Digital Consumer” has become a wildfire fueled by the arrival of AI and unfamiliar technologies lacking broad, supporting skills and experiential knowledge (of the embryonic solution). Can leadership make the mindset and technology provisioning transition to data-centric implementations before time runs out—and new non-traditional competitors able to make the adaptation dominate the industry?

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)