Home Builder Sentiment Surges on Falling Interest Rates

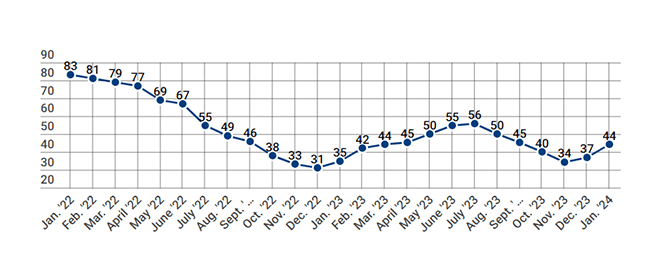

(Chart courtesy of National Association of Home Builders/Wells Fargo)

Builder confidence in the market for newly built homes climbed seven points to 44, according to the National Association of Home Builders/Wells Fargo Housing Market Index.

This second consecutive monthly increase in builder confidence closely tracks with a period of falling interest rates.

“Lower interest rates improved housing affordability conditions this past month, bringing some buyers back into the market after being sidelined in the fall by higher borrowing costs,” NAHB Chairman Alicia Huey said.

CoreLogic Chief Economist Selma Hepp noted homebuilders are clearly feeling more optimism due to the prospect of lower mortgage rates through 2024. “This will help bring more home buyers back to the purchase market,” she said. “On the other side, housing starts are not keeping pace with the demand, so the amount of homes available for sale will remain tight.”

NAHB reported that even as mortgage rates have fallen below 7% over the past month, many builders continue to reduce home prices to boost sales. In January, 31% of builders reported cutting home prices, down from 36% during the previous two months and the lowest rate since last August. The average price reduction in January remained at 6%, unchanged from the previous month. Meanwhile, 62% of builders provided sales incentives of all forms in January. This share has remained stable between 60% and 62% since October.