CBRE: Affordable Housing Investment Down From 2021, but Still Strong

(Image courtesy of CBRE; Breakout image courtesy of Marlene Leppänen/pexels.com)

CBRE, Dallas, found affordable housing investment trends over the past few years have tracked some aspects of the overall multifamily market.

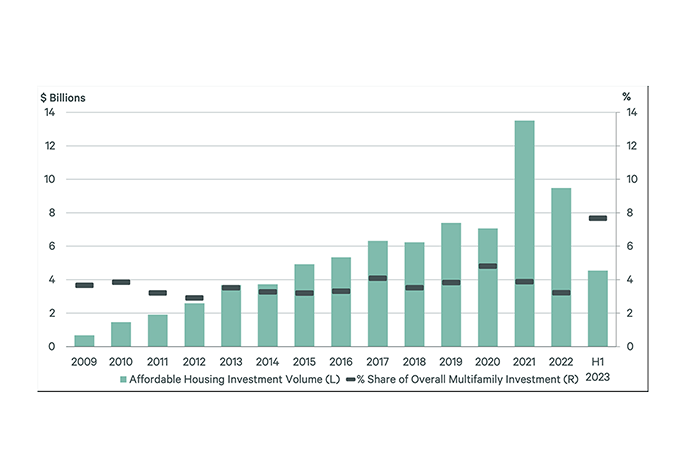

Affordable housing investment volume was at an all-time high of $13.5 billion in 2021–a marked increase from $674 million in 2009. While activity has declined from those highs, the quarterly average investment in affordable housing in the first half of 2023 is up 50% from pre-pandemic levels of 2015-2019.

Affordable housing averaged 3.6% of the annual share of total multifamily housing between 2009-2022, but hit 7.7% in the first half of 2023.

From 2009 to Q2 2023, the average affordable housing unit price increased by 133%.

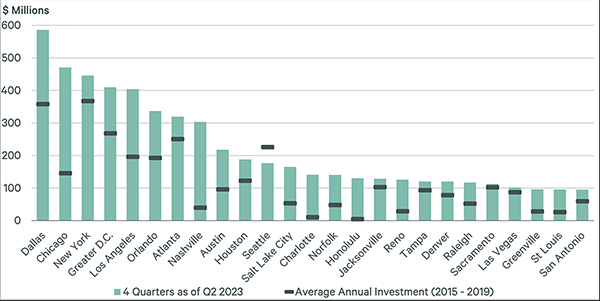

The investment varies by area. For example, Dallas, Chicago, Los Angeles and Nashville, Tenn., have seen significant gains in their annual average investment level. Overall, the Sun Belt region has seen a notable increase and now accounts for more than half of all affordable housing investment.

Investment has fallen in areas such as Seattle, Boston, Miami and Portland, Ore.

CBRE has defined affordable housing as that which offers below-market rents resulting from certain regulatory requirements, typically associated with tax incentives or other subsidies.