Renting, Buying Both Prompt Affordability Concerns, ATTOM Finds

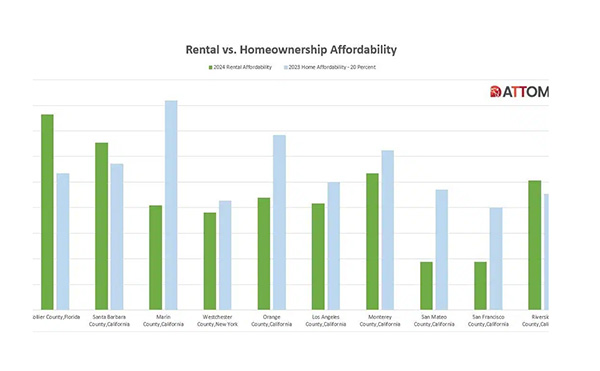

(Top 10 counties with the highest rental rates in 2024, via ATTOM)

ATTOM, Irvine, Calif., released its 2024 Rental Affordability Report, showing median three-bedroom rents in the U.S. are more affordable than owning a similarly sized home in the vast majority of local markets.

The report warns affordability is at issue for both renting and owning a home, but median rental rates require a smaller portion of average wages than three-bedroom homeownership expenses in 88% of the counties ATTOM analyzed.

Both rental rates and home prices have risen recently amid a variety of economic forces. And, median rents for three-bedroom homes have increased more over the past year (or fallen less) than median prices for single-family homes in 62% of the analyzed counties.

“Finding an affordable home remains a daunting prospect around the country for average workers, regardless of whether they want to buy or rent. Continuously increasing home prices contribute to the escalation of rental costs, making both buying and renting properties a challenging endeavor across most of the United States,” said Rob Barber, CEO at ATTOM. “But the latest data shows that even as rents are growing faster, they remain more affordable than owning.”

The affordability gap is particularly noticeable in the nation’s most populous counties. In nearly 75% of markets with at least 1 million residents, the portion of average local wages consumed by renting is at least 10 percentage points lower than the portion required for typical major home ownership expenses. (Comparisons assume a home-purchase mortgage based on a 20% down payment, ATTOM said. Major ownership expenses include mortgage payments, property taxes and insurance).

The biggest gaps are in:

• Honolulu. (Median three-bedroom rents are 67% of average local wages while a single family home consumes 134%).

• Kings County, Brooklyn, N.Y. (72% for renting vs. 136% for owning).

• Alameda County, Oakland, Calif. (51% for renting vs. 108% for owning).

• Santa Clara County, San Jose, Calif. (29% for renting vs. 83% for owning).

• Orange County, Calif., near Los Angeles. (88% for renting vs. 136% for owning).

Regionally speaking, both rental and homeownership costs tend to be more affordable in the South and Midwest.

Rents are growing faster than wages in 197 of the 338 counties analyzed in the report. However, wages are rising faster than median home prices in the same number of counties.