Pending Home Sales See Biggest Jump in Over Two Years

(Chart courtesy of Redfin)

Homebuyers came out of the woodwork in December as mortgage rates posted the biggest monthly decline since 2008.

Pending home sales rose 4.1% month over month in December on a seasonally adjusted basis–-the biggest increase since September 2021-–to the highest level in more than a year, according to Redfin, Seattle.

In a new report, Redfin reported pending home sales climbed 5.9% from a year earlier, the biggest annual gain since June 2021.

The firm said pending sales jumped because falling mortgage rates lured buyers to the market. The average 30-year-fixed mortgage rate fell to 6.82% in December from 7.44% in November, the biggest monthly decline since 2008. “Buyers who were casually looking when rates were above 7% are now getting serious,” the report said.

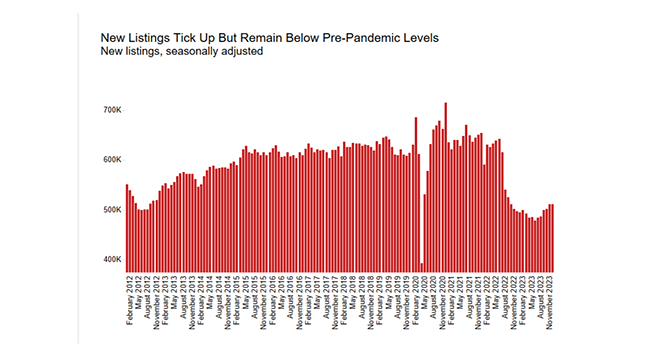

The dip in mortgage rates is also bringing sellers off of the sidelines–though they have not returned with as much intensity as buyers, likely because a majority of them don’t want to give up the low mortgage rate they scored during the pandemic. Redfin reported new listings rose 0.1% month over month to the highest seasonally adjusted level since September 2022, and were up 2.7% year over year—the largest increase since July 2021.

While housing supply has ticked up, it remains below pre-pandemic levels. Active listings rose 3.1% month over month on a seasonally adjusted basis but fell 5.1% from a year earlier.

The report noted that while demand jumped in December, January is off to a slower-than-expected start, likely due to severe winter weather in many parts of the country. Redfin economists expect the market to pick up as spring approaches, as long as mortgage rates don’t shoot up.