Berkadia: Single-Family Rental Market Continues Robust Growth

(Image courtesy of Berkadia)

Berkadia, New York, released its latest outlook on single-family rentals and build-to-rent properties, finding the single-family rental market is the fastest-growing segment in the nation’s housing landscape.

Institutional capital has continued to grow in the single-family rental market, with $60 billion in 2022.

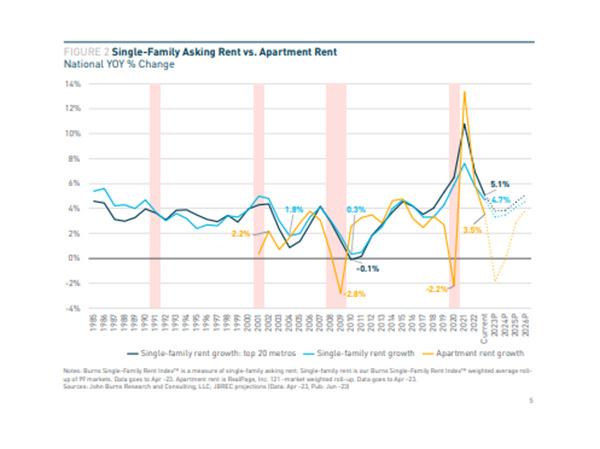

Single-family rents are expected to end 2023 with growth of 3%; Berkadia posited that they’ll grow more than 3.5% in 2024, more than 4% in 2025 and more than 5% in 2026. They are expected to outperform home prices and apartment rent growth.

From 2000-2019, single-family annual rent growth averaged 3.1%, compared to 2.8% for more traditional multifamily properties.

Within the build-to-rent space, specifically, asking rents rose more than 3% year-over-year in 16 U.S. markets as of March 2023.

Berkadia points to a number of factors as propelling the single-family rental demand. From a renter’s perspective, there’s appeal across generations, the rising cost of housing, migration patterns and neighborhood preferences, increased space requirements for many Americans as they continue to work remotely and demand for low-density living.

From an investor perspective, there’s current low institutional exposure for the asset class, strong operational fundamentals, options in exiting the investment and a national housing shortage that drives need.