BeSmartee’s Tim Nguyen on 2024 Strategies for Mortgage Executives–Breaking Down Expenses, Technology and the 20% Volume Surge

Tim Nguyen is the CEO & Co-Founder at BeSmartee, a fintech powering the digital transformation of mortgage and commercial lenders. As CEO Tim sets the direction of the company, defines its product vision, defines its culture, leads mergers & acquisition initiatives, and stays close to the company’s most strategic clients and partners.

Tim comes from an entrepreneurial family background, having taught himself to code and launch multiple online businesses in high school, advising local companies ranging from $5-$100M in annual revenues and as an active investor in numerous startups.

In his personal life Tim enjoys family, writing, music, farming, no limit poker, baseball, MMA and basketball.

Many of my industry colleagues are excited and optimistic about the recent rate movement and key indicators pointing to a 20% increase in volume (namely driven by rate-and-term refinancing activities) in the second half of 2024. Finally, it appears that we’ve reached a plateau, and if you are to believe economic forecasters, they are forecasting three one-quarter point drops by the Fed in 2024.

But while the mortgage technology company I founded, BeSmartee, will benefit from this rate direction, most of the industry originators will not. See, for the past 18 months I have seen mortgage lenders pause and retract their investments in recruiting, marketing, training, technology, automation and servicing, to name a few; and this means that most originators will not capture a significant enough portion of that 20% increase in volume to make a meaningful impact.

The largest servicers who have been acquiring massive amounts of servicing, and who have set up a better retention mousetrap, will be the primary beneficiaries. There’s simply not enough rate-and-term refinances to go around. The peanut butter will not be spread evenly across the industry.

If you’re relying on an increase in refinances to save your business, you’re doing something wrong. That’s called living check-to-check. Hope is not a plan. Interest rates are something none of us have any direct control over. We can only ever simply plan and react.

Read on to learn about two core areas to focus on in 2024 to build a long-term profitable business model with an expense structure that can stand up to the cyclical nature of our industry.

MBA’s Quarterly Mortgage Bankers Performance Report

According to the MBA’s most recent report, if you factor out the servicing business line, only one-third of reporting mortgage companies would have been profitable. This makes six consecutive quarters where production income has been in the red. And, with Q4-2023 and Q1-2024 expected to be more of the same volume, this means we will likely see eight consecutive quarters of negative production income before the data can get better.

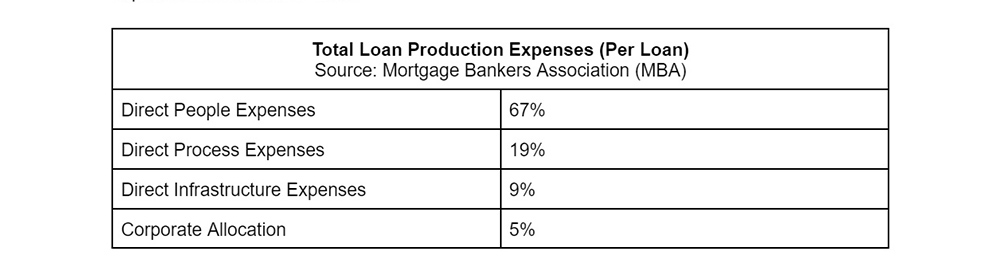

Q3-2023’s total loan production expenses were $11,441 and is higher than Q3-2022’s $11,016. How in the world does this make any sense? Peel back the layer of the onion and you’ll find expenses breakdown as such:

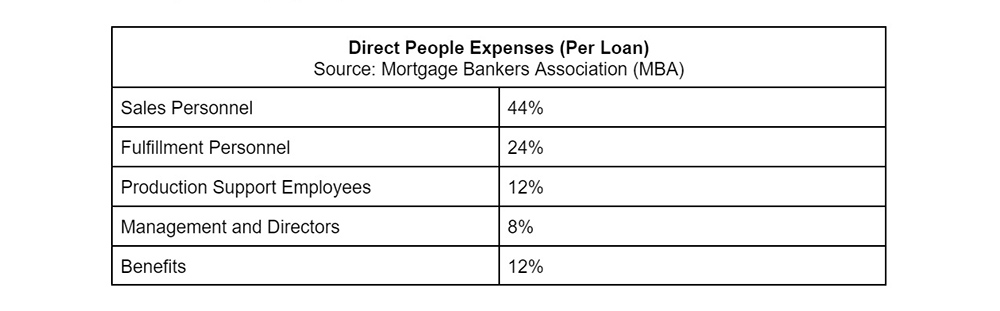

Now, if you dig into that 67% you wouldn’t be shocked to see that sales personnel represent 44% of your direct people expenses as such:

Any industry outsider would say, “reduce your sales compensation plans,” and in my humble opinion, they wouldn’t be wrong. I’ll go on the record that I’m a proponent of revising loan officer compensation plans, but since most lenders wouldn’t dare touch loan officer compensation, we’ll leave that off the table for today. In other words, we’ll explicitly designate loan officer compensation as a “handicap” that we need to work around and yet still build a profitable mortgage lending business.

So… what’s a mortgage executive to do? If you know how to look at a P&L the answer is simple. Reduce all your other expenses everywhere else to get to breakeven in the cycle we’ve been in for the past 18 months. Profits will then come from normalized origination volume, specifically:

-Reduce all your other people expenses

-Reduce your direct process expenses

-Increase your infrastructure (namely technology) expenses, provided you get #1 and #2 directly above

Only a direct optimization of processes, the people who support it and the integrated technologies that run it all can help.

However, some mortgage executives would lead you astray and advise that technology is not a panacea, and that technology oftentimes increases your per loan costs. But, while I agree with them 100%, some of these mortgage executives are also leaving out the reasons why. In my humble opinion, it boils down to two reasons why below:

First, most technology stacks are poorly chosen, implemented and do a mediocre job of talking to each other, if they do at all

Second, your technology agreements are themselves unfavorable to your success.

Let me explain why, and what you can do about it.

The Technology Stack

I have observed that most mortgage lenders choose their technology stack based on a best-of-breed approach, (i.e. you do your best to vet out multiple vendors per category and you end up choosing a LOS, POS, CRM, PPE, fee aggregator, document provider, appraisal management company and so on). But choosing in that way leads to a higher chance that those systems do a poor job of integrating a massive amount of data across a loan lifecycle that is complex and dynamic. You suffer data gaps, fill it with manual workarounds and then lose real-time insights that lead to increasing costs and missed opportunities everywhere else.

Instead, shop your technology stack based on technical compatibility and collaboration between vendor partners. You need to go beyond “are you integrated with vendor X?” Instead, ask for the:

-Dataset itself

-Direction of the dataflow

-Timing of updates

-Data diagrams and workflows

-Vendor’s commitment to fill integration gaps as they are identified

Next, don’t underestimate the power of collaboration and the day-to-day working synergies between your technology stack providers. Integrating software platforms is a never-ending commitment that requires multiple parties to engage one another. If one vendor is ready while the other vendor is either unable to or is simply lackadaisical, there will not be a successful integration that meets your expectations.

In my role, I prioritize strong collaborative relationships with the CEOs of our integrated partners, spanning from LOS to document providers to CRM. This proactive approach ensures that executive management from both organizations are aligned with our mortgage lender clients’ mutual objectives. By aligning the vision and driving collaboration at the executive level, we lay a robust foundation for mutual success. Both teams know that they can rely on each other to navigate challenges effectively, reinforcing our commitment to excellence together.

Your Technology Agreements

Traditionally, mortgage technology vendors make the bulk of their money on a success-basis, (i.e. when the loan closes). On the surface, this makes sense to most mortgage executives, (i.e. vendors will make money when we make money). But this is very wrong and is actually uncommon in most other industries. Most technology platforms across other industries receive compensation for the use of the technology, not a revenue outcome.

If mortgage technology vendors only make money when you make money (and we’re talking about tens of dollars versus thousands of dollars per loan), then what is a mortgage technology vendor to do? They compensate for it in their per-close loan fee, which means your cost basis is fundamentally not scalable out of the gate. It’s a straight-line and straight lines do not scale.

Some mortgage executives may be proud of tiering structures they’ve negotiated, but I’m telling you that it’s not enough. The tiers are oftentimes too high to achieve, which means you’ll only realize the gain when volumes exceed expectations, making the net/net impact to you negligible whether you miss plan or make plan.

Instead, good technology agreements are subscription-based, meaning they are fixed for near unlimited usage, regardless of the number of loans you may close within a given month. Therefore, when you miss plan you have downside protection, and when you make or exceed plan, you have upside gain, (i.e. you don’t get penalized for overachieving).

You wouldn’t put up with Netflix charging you a transaction fee for each video you watch, so don’t put up with it in your mortgage business. Subscription-based plans are also great for the technology vendor, who has less variable income, making it easier to budget and reinvest ahead of time into furthering the software platform you rely on every day.

Put simply, stop paying away your margin.

Conclusion

For most mortgage lenders, 2024 will be a better year, but not a great year due to too many chasing a finite market. 2024 is what I call a “foundational year,” where you rebuild the very structure your business sits upon.

Do your best to take your piece of that 20% pie in the second half of 2024, and then reinvest that cashflow for the long haul and never have your business live check-to-check again.

(Views expressed in this article do not necessarily reflect policies of the Mortgage Bankers Association, nor do they connote an MBA endorsement of a specific company, product or service. MBA NewsLink welcomes your submissions. Inquiries can be sent to Editor Michael Tucker or Editorial Manager Anneliese Mahoney.)