Luxury Home Prices Hit New High; Record Share of High-End Buyers Pay Cash: Redfin

(Illustration courtesy of Redfin)

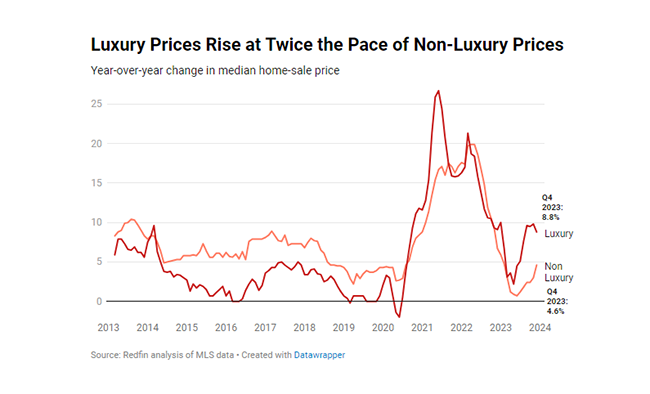

The typical U.S. luxury home sold for a record $1.17 million in the fourth quarter, up 8.8% from a year earlier, according to Redfin, Seattle.

Prices of non-luxury homes increased at half the pace, rising 4.6% year over year to a record $340,000, Redfin said in a new report.

The analysis defines luxury homes as those with a market value in the top 5% of their respective metros and non-luxury homes as those in the 35th-65th percentile.

The outsized increase in high-end home prices, along with a jump in luxury new listings and improving sales, signal that affluent homebuyers and sellers are becoming more active, the report said.

In addition, the share of high-end homes bought in cash reached a record high. Nearly half (46.5%) of the fourth quarter’s luxury purchases were made in cash, up from 40% a year earlier.

“Luxury prices are rising at twice the rate of non-luxury prices largely because so many affluent buyers are able to buy homes in cash, rendering today’s elevated mortgage rates irrelevant,” the report said, noting high mortgage rates have a chilling effect on the rest of the market by upping borrowers’ monthly payments.

“A lot of luxury buyers are coming in with cash, snapping up expensive homes,” said Heather Mahmood-Corley, a Redfin agent in Phoenix.

Low inventory of high-end houses is another factor pushing prices up, Redfin reported. “Even though the supply of luxury homes surged from a year earlier, it’s still well below pre-pandemic levels, leading to competition from well-heeled buyers over a limited number of homes,” the report said.

Redfin Senior Economist Sheharyar Bokhari said more high-end listings will likely appear as the year progresses, which should temper price growth. “Overall, that’s a good thing for the high-end market: Sellers will still fetch fair prices, buyers will have more to choose from and sales should tick up,” he said.