ICE ‘First Look’ for December: Foreclosure Starts at 18-Month Low

(Image courtesy of ICE)

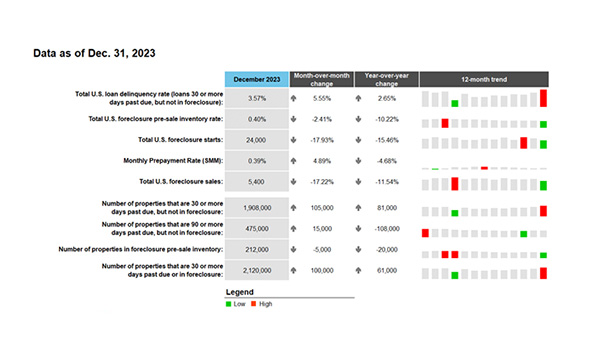

Intercontinental Exchange Inc., Atlanta, released its “first look” at mortgage performance data for December, noting that at 24,000, foreclosure starts marked an 18-month low in new activity. Total active foreclosures are the lowest since March 2022, and 25% below pre-pandemic levels.

But, ICE also reported that delinquencies rose in large part due to a quirk of the calendar.

December ended on a Sunday, delaying the processing of mortgage payments. As a result, the national delinquency rate hit 3.57%, up 19 basis points from November (or up by 5.6%).

However, ICE noted, that’s lower than past instances in which December ended on a Sunday–those hold a 9.9% average rise. For Decembers that don’t end on a Sunday, the average increase is 1.4%.

Serious delinquencies–which ICE defines as 90+ days past due–rose to 475,000. Yet, that’s still 19% down year-over year.

There were 5,400 foreclosure sales, down 17.2% from November and the smallest number since February 2022.

Prepayment activity rose 4.9% to a single month mortality rate of 0.39% on improving interest rates.

The states with the highest noncurrent percentage are Mississippi (8.37%), Louisiana (8.17%), Alabama (6.07%) and West Virginia and Indiana (both 5.54%).

The states with the lowest noncurrent percentage are Colorado (2.09%), Washington (2.17%), Montana (2.21%), Idaho (2.26%) and California (2.31%).