MBA Chart of the Week: End of Quarter Delinquency Status

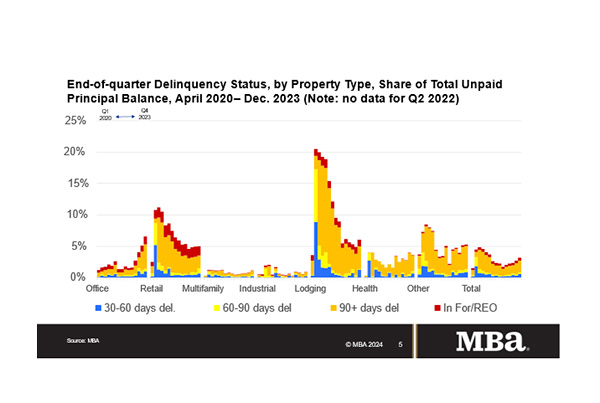

Ongoing challenges in commercial real estate markets pushed the delinquency rate on CRE-backed loans higher in the final three months of 2023.

Delinquency rates jumped to 6.5% of balances for loans backed by office properties and to 6.1% for lodging-backed loans. Delinquencies for loans backed by retail properties remained elevated from the onset of the pandemic but were unchanged during the quarter. Delinquency rates for multifamily and industrial property loans both increased marginally but remain much lower.

One gets a view into the ways lenders have been addressing these issues through banks’ Q4 earnings releases – and the focus is clearly on office loans and provisioning for loan challenges that have not yet shown up.

Many of the early-reporting banks showed low (or even non-existent) delinquency rates for their office loans but, after reviewing their portfolios and anticipating what may be coming, chalk up higher shares of office loan balances as non-performing (which includes “payment in full of principal or interest is not expected”) and still more as “criticized” (meaning the loan, at the least, deserves management’s close attention). At one large bank, at the end of the fourth quarter, 0% of office loan balances were delinquent, but 8% were categorized as non-performing, and nearly a quarter were criticized.

Anticipating that office market challenges will work their way through the system; many banks have already reserved an amount equal to 8–10% of their office loan balances to cover any future office loan losses.

As we noted more than a year ago in our paper A Framework for Considering Office Demand in a Post-pandemic World, “it is unlikely that we will see the office market return to its former shape, size, and dimensions.” That reality is slowly making its way from the desk to the building to the property owner, and now to the loan. Lenders, including banks, are showing they see this reality as clearly as anyone.

Jamie Woodwell (jwoodwell@mba.org)