Matic: Challenges in Home Insurance Market Likely to Continue

(Image courtesy of Matic)

Matic, Columbus, Ohio, in a recent year-end report noted 79% of mortgage lenders experienced an increase in problems with home insurance in the past year, among other challenges. Moreover, the company predicted such challenges may persist into 2024.

High insurance rates are impacting mortgage eligibility–68% of lenders said that insurance had caused an issue related to a borrower’s debt-to-income ratio. And 58% of lenders reported they saw a delay due to the time it took for a borrower to secure an insurance policy.

“While lenders have previously faced issues with delays in the home insurance process, there are several new contributing factors that are compounding the problem, including pricing, low availability and longer customer service wait times as homeowners were forced to switch to new carriers en masse,” said Ben Madick, CEO and Co-Founder of Matic Insurance. “As lenders already grappled with decreased volume in 2023’s difficult housing market, these home insurance issues further exacerbated their challenges with increased costs and a less efficient closing process.”

Homeowners saw an average 8.6% premium increase for new policies in 2023, compared with 6.4% in 2022 and 2.4% in 2020. The average premium increase for renewal policies was 23.7%.

Matic also found policy availability decreased substantially in 2023. Factors such as increased and more severe natural disasters and inflation sparked carriers to make changes.

In 2023, there was a 35% decrease in available home insurance policies. Online quote declinations reached an all-time high of 44% in June. States other than the expected ones–namely Florida and California–saw issues as well, including Georgia, South Carolina, New Jersey, New York and Arizona.

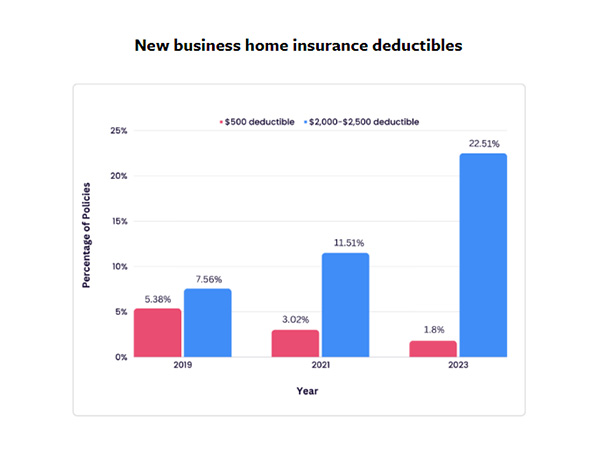

Matic reported an increase in home insurance deductibles, with new policies with all other perils deductibles between $2,000 and $2,500 up almost 200% since 2019.

For renewals, there have been automatic deductible increases by some insurance carriers. Renewal policies with deductibles between $2,000 and $2,500 increased by 63%. Moreover, carriers have begun adding required wind/hail deductibles in some areas.

And, another 2023 trend was uncertainty related to the National Flood Insurance Program–while the program was ultimately extended until next month, it remains in need of an overhaul.