Freddie Mac Forecasts Tempered Multifamily Growth, Increased Volume in 2024

(Chart courtesy of Freddie Mac Multifamily)

This year should bring growth in the multifamily sector despite continued headwinds, and the long-term forecast for the asset class remains positive, according to Freddie Mac Multifamily, McLean, Va.

The GSE recently released its 2024 Multifamily Outlook, which said an elevated multifamily supply pipeline will moderate potential rent gains. Rent increases should be positive in 2024, but below longer-run averages, the report said.

The outlook also predicted 2024 vacancy rates will be “modestly higher than average” but noted a more stable interest rate environment could help spur transaction volume this year, with demand for rentals driven by prevailing demographic trends and expensive for-sale housing.

“The economy appears to be on track for a soft landing, although it may be bumpy [in 2024],” said Sara Hoffmann, director of multifamily research at Freddie Mac. “In 2024, the multifamily market may see additional strain from high levels of new supply and continued high interest rates but remains a favorable asset class given the state of the for-sale market and long-term demographic trends.”

The outlook projects expected gross income growth of 2.1% for the year.

Other forecasts include:

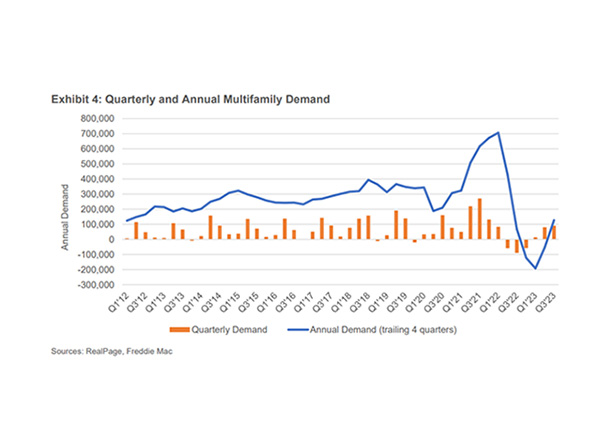

Multifamily demand will likely remain positive but weaker than pre-pandemic rates.

The 2024 baseline forecast is for 2.5% rent growth for the year, slightly below the annual average from 2000 to 2022. “The impacts of high supply vary across the country, with the Sun Belt and Mountain West regions expected to see the highest levels of new supply and the most pressure on rent growth,” the report said.

Multifamily vacancy rates will likely remain relatively stable this year despite a predicted peak year for deliveries. The 2024 forecasted vacancy rate could rise to 5.7%, 40 basis points higher than the 2000 to 2022 average.

“Although interest rates are expected to remain elevated in 2024, additional stability should result in stabilized cap rates and property values,” the report said. “By allowing buyers and sellers to agree on asset value, this trend could help drive transaction volume in the multifamily market.”