A Year of Technological and Industry Convergence: Mark Dangelo

The 2024 U.S. mortgage industry will continue to face many opaque market drivers in the months ahead—rates, supply, economic, political, insurability, and consumer—all driven by 2023 results that historically represents the least affordable homeownership environment. However, while 2023 housing sales breaking 28-year low and industry participants struggling for survival, the seeds of industry reformulation are already sprouting across a convergence of skills and technologies—if we know where to focus. But where Is the focus being concentrated?

For mortgage and financial leadership concentrating on additional efficiencies and revenue operations, suggestions of investment in something new that brings more change, more uncertainty, and more advancements is akin to speaking softly while facing into the destructive and uncontrollable winds of a hurricane. Specifically, how will these AI/ML algorithmic solutions be created, staffed, designed, and upskilled against rapid-cycle improvements, embedded integrations, privacy-preserving digital assets, growing regulation, and cyber and information security challenges?

Currently broad-spectrum business and technical strategies assume that AI will represent the kaleidoscope of options and capabilities, which will digitally transform processes and recast product pricing and time-to-completion. Even with the rising tide of innovation and technology, are the leaders and their teams up for the transformations?

While the enthusiasm and promise of varied AI solutions—generative, general, ML (supervised, unsupervised, reinforcement), RPA, NLP, predictive—has captivated the imagination of CTO’s, the pace of advancements and capability has been nothing short of breathtaking.

For mortgage leaders, the conditions are quickly moving from survival to growth, and the decisions made now will set the conditions throughout the rest of 2024. The critical strategies and designs of operations are changing underneath the hope for a robust, future mortgage ecosystem.

Creating context for AI, industry segmentation, and tech convergence

Whereas the progression and hype of AI will continue to dominate the headlines, early market solutions and applications will be challenged by scalability, data privacy, legal risks, and auditability. Yet for all the promise and potential, there is a widespread convergence of technologies and industry requirements into ecosystems of data-driven solutions. These integrations—embedding, cascading, and democratized—are remaking Fintech offerings and the enterprise software once utilized for end-to-end systems of record (SOR).

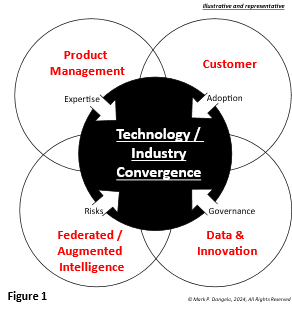

Figure 1 illustrates the groupings of traditionally segmented solutions based on the value they deliver to the enterprise and systemized into detailed software requirements. Of note are the impacts –industry expertise, customer adoption, risks and their mitigation, and growth and convergence of data both from within and outside the enterprise. Examples of the traditional solutions were LOS’s designed for origination, blockchain delivered servicing systems, and secondary market securitizations for non-conforming loans. Whatever the past, there are three axioms; 1) the context of the future solutions now is firmly about continuous digital transformations, 2) data leverage and monetization will dominate architectures and financial justifications, and 3) the convergence of the four as a foundation for AI, ML, and RPA efficiencies with lower volumes and increased oversight is changing the outcomes and ROI’s.

However, the missing and implied variables reside with not just the rapid adoption of technological advancements, but their ongoing adaptation that requires next-gen skills, precision foci, risk mitigations, and changing, data-driven consumer offerings. These representative contextual segments provide the conceptual divisions of how to leverage existing investments and operational complexities into the innovation convergence now underway.

Again, the question of who will lead to deliver the focus? How will it be architected and provisioned to ensure a balance of delivery against rapid changes? And what is the mix of hard and soft skills needed to glue together business models, technologies, and data (e.g., repositories, transactional, synthetic, meshes) against competitive forces that are originating from outside?

The pieces begin to shift and coalesce

Much like a detailed mosaic or a kaleidoscope turned to reveal continually changing and unique images, 2024 will be the Year of Convergence. An implication of the rapid advancements of AI capabilities driven by unprecedented investor enthusiasm, is that as the mortgage and financial markets are remade with lower volumes. Moreover, the barriers that once defined originators, servicers, and secondary market participants will blur leading to increased collaboration and data specialization.

The binding agent for the accelerating innovation coalescence will be data in all its volumes, variations, and validity. As data moves into complete separation from the ideas of workflows and processes, these monetized building blocks encapsulated with their operational rules will create interoperability and auditability of elements once thought too expensive to implement as a granular level.

Yet the missing variable will be what will it take to create adaptable teams in the future who can efficiently operate across iterative and emerging data fluidity? Where will these additional skills originate from—AI, rules-based systems, regulators—and what about the constant demands for reskilling to meet continual change?

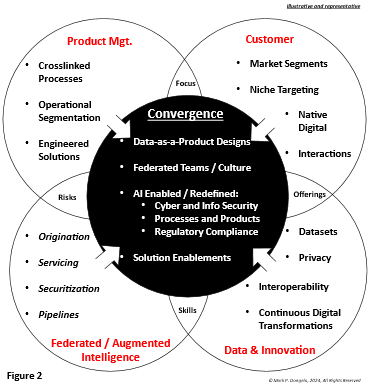

In Figure 2, the expansion of the four contextual segments are broken down. Illustrated in a conjunction of features, functions, and reusability the blending of solutions are becoming normalized beyond just larger BFSI and mortgage participants. What this “word salad” of solutions and strategies illustrate is rapid innovation and technological solutions are moving well beyond the SaaS application mindsets that launched the cloud industry since the last time the mortgage industry corrected.

With data being a binding agent, we are increasingly understanding that application maturity is being discussed not just within data warehouses or lakes of structured or unstructured data, but with SOR’s as being a) virtualized, b) federated, c) meshed, and even d) democratized. Again, to take advantage of not just industry transformations but also converging technologies, the methods, techniques, teams, and most importantly, leadership must also move in concert to excel at the future market characteristics.

In the end, it is the teams, not just the technical advancements that create the digital transformation initiatives which will reimage mortgage and BSFI market segments. Also the overlayed priorities or plans-of-attack that set the pace, change the culture, and out distance the competition create the roadmaps needed.

Mapping out layers of priorities, digital initiatives, and BAU

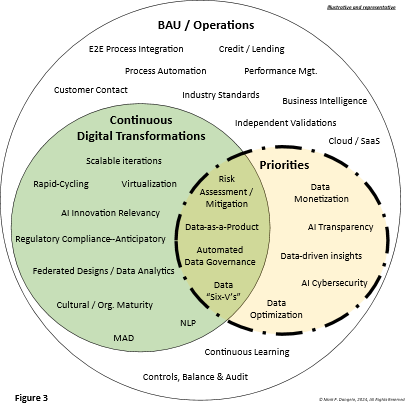

Figures 1and 2 provide the landscape of convergence that is taking place within the industry and moving in concert with advancements in data, AI, compartmentalization, and cloud computing. Yet these general composites do not provide the priorities or initiatives that will be important for mortgage and BFSI firms seeking to move beyond efficiency improvements and into expansive revenue opportunities.

Factoring in vast consumer shifts of behaviors, data privacy, and industry engagement, the drivers setting the cadence of advancement is increasingly outside the control of industry personnel and the traditional systems held in high regard (e.g., LOS, POS, servicing, loss-mitigation, et al).

Moreover, at the end of 2023 (see Transunion), there were over 100 million U.S. consumers who actively manage their information and credit scores. The consumer shift of mindset around credit and their consumption of financial products including mortgage have materially altered how front, middle, and back-office systems interact and are fundamentally segmented. As represented in Figure 3, and to put meaningful detail around the conceptual representations of Figures 1 and 2.

For leaders and their teams needing to leverage cross-system convergence, there are three breakdowns that must actively be addressed as part of tangible implementation programs. First, and most familiar, are BAU and operations that were traditionally used to achieve incremental improvements. These core competencies in concert with off-the-shelf software were focused on competitor offerings and solutions. It was not about breakout innovation but concentrated on efficiencies. They still are useful, but as convergence transforms the vast and fragmented solutions defined by Fintech capabilities, their contribution to bottom line profitability has shrunk.

The second group of converging solutions encircles continuous digital transformations. As we move through these groups of competencies and offerings, we note that the complexity and risks of their implementation grow. Additionally, the pool of resources and prescription mindsets shrink due to rapid advancements and cultural resistance. Yet these are not the greatest priorities facing technologies and industries being remade across products, consumers, federated intelligence, and data innovations. It is their convergence, their interoperability, their layered value propositions where the benefits are differentiated compared to traditional implementations.

The most critical set of convergence is identified in Figure 3 as Priorities. These disciplines and skills require vastly remade industry focus and team construction coupled with iterative, agile solution approaches. Additionally, it fundamentally alters the relationships between outsourcers, software providers, and consultants. In the end, for mortgage industry leaders to grow topline revenues, the envelope of priority items requires a shift of focus and returns. Leaders and architects must realize that implementation of all items listed in Figure 3 as standalone solutions will not provide sustainable gains—just more chaos and costs trying to support fragmented capabilities.

As solutions become interconnected, leaders are now discovering it will require vastly different approaches, justifications, and planning cycles compared to the markets defining the cycle of 2009-2023. The next industry cycle is here, AI and advancing technologies are undergoing rapid-change, and data is the means to glue it all together.

However, the forgotten variables for success during the explosion of it all is people, organizational culture, and the blending of hard and soft skills necessary to deliver the convergence of Figure 3 BAU, continuous digital transformations, and emerging priorities at scale. And like the variable features and data ingestion demands of AI solutions, the “proven” mortgage industry prescriptions of people, process, and technology of the past cycle will prove hopelessly deficient.