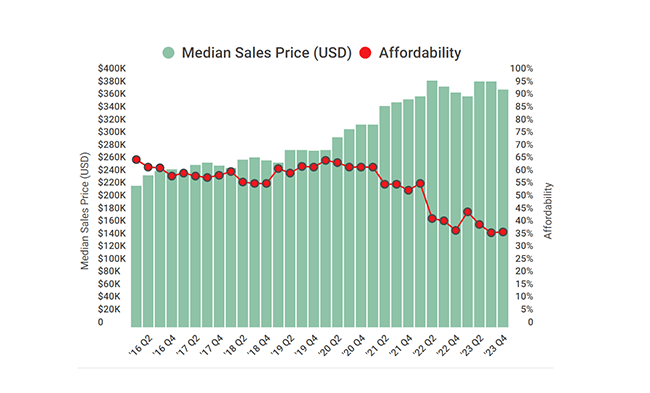

NAHB/Wells Fargo: Housing Affordability Nears Historic Low

(Illustration courtesy of NAHB and Wells Fargo)

Mortgage rates that hit a 20-plus-year high during the fourth quarter and elevated construction costs pushed housing affordability to nearly its lowest level in years, according to the National Association of Home Builders/Wells Fargo Housing Opportunity Index.

The HOI found just 37.7% of new and existing homes sold between the beginning of October and end of December were affordable to families earning the U.S. median income of $96,300, nearly identical to the 37.4% posted in the third quarter, which was the lowest reading since the organizations began tracking affordability consistently in 2012.

“Even as overall inflation continues to moderate, shelter costs continue to put upward pressure on inflation, accounting for more than half the inflation gains in the latest Consumer Price Index,” said NAHB Chief Economist Robert Dietz.

NAHB Chairman Alicia Huey noted affordability conditions will likely show some gradual improvement this year because mortgage rates peaked in the fourth quarter and are now well below 7%.

The HOI reported the national median home price dipped to $375,000 in the fourth quarter, down from $388,000 in the third quarter. Meanwhile, average mortgage rates increased more than 30 basis points from 7.13% in the third quarter up to 7.44% in the fourth quarter–the highest rate in the HOI series history.