Down Payment Resource Study: 135 Homebuyer Assistance Programs Added in 2023

(Image courtesy of Down Payment Resource/Breakout image courtesy of Jessica Bryant/pexels.com)

Down Payment Resource, Atlanta, released its Q4 2023 Homeownership Program Index Report, finding there were 135 homebuyer assistance programs introduced throughout the year, during a period when home affordability has been top-of-mind for many.

“This surge in programs, which now totals 2,294 nationwide, represents a concerted effort by housing agencies to expand opportunities and break down barriers to homeownership,” said Rob Chrane, Founder and CEO of DPR. “With a significant increase in programs for manufactured homes, multi-family properties, and specific buyer demographics like service members and Native Americans, this year’s report underscores a growing commitment to diversify housing solutions and empower a broader spectrum of aspiring homeowners.”

In terms of notable trends, DPR noted 804 programs now allow for the purchase of a manufactured home, a 20% increase year-over-year. Additionally, 686 programs allow for the purchase of a multi-family property, up 8%.

Four hundred and forty-eight are funded by state housing finance agencies (up 2% year-over-year), 922 are available via municipalities (up 5%) and 475 are available via nonprofits (up 15%).

DPR reported 194 are “incentive” programs, that target a specific type of homebuyer by profession or ethnicity, with a 47% increase in programs for service members and veterans and a 13% increase in programs targeting Native American buyers.

Of the new programs added since Q4 2022, rehab assistance programs saw the largest year-over-year growth–up 300% over that period.

Below market value/resale restriction programs saw the second-largest jump, at 112% year-over-year. Matched savings programs rose 34%, and grant programs are up 13%.

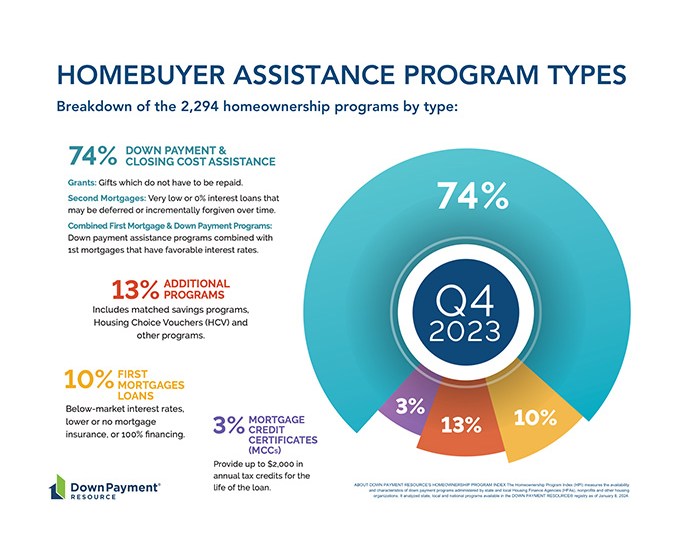

Looking at the full selection of 2,294 programs, 81% are currently funded, 9% are inactive, 4% are on a waitlist for funding and 6% are temporarily suspended. Almost three-quarters are for down payment or closing cost assistance, 10% are first mortgages, 3% are Mortgage Credit Certificates and 13% are other program types.