Zillow: Home Buyers Need to Earn $47,000 More Than in 2020

(Illustration courtesy of Zillow)

Home shoppers today need to earn more than $106,000 to comfortably afford a home, a new Zillow analysis found.

The figure is 80% more than in January 2020, “showing how the math has changed for hopeful buyers,” Zillow said in a new analysis.

In 2020, a household earning $59,000 annually could comfortably afford the monthly mortgage on a typical U.S. home, spending no more than 30% of its income with a 10% down payment. That was below the U.S. median income of about $66,000, meaning more than half of American households had the financial means to afford homeownership.

Now, the roughly $106,500 needed to comfortably afford a typical home is well above what a typical U.S. household earns each year, which the Census Bureau’s American Community Survey estimates at about $81,000.

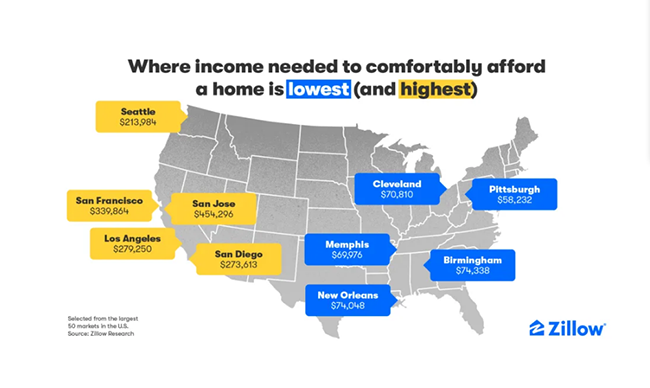

“Housing costs have soared over the past four years as drastic hikes in home prices, mortgage rates and rent growth far outpaced wage gains,” said Orphe Divounguy, a senior economist at Zillow. “Buyers are getting creative to make a purchase pencil out, and long-distance movers are targeting less expensive and less competitive metros.”

Divounguy noted mortgage easing down has helped, “but the key to improving affordability long term is to build more homes,” he said.

A monthly mortgage payment on a typical U.S. home has nearly doubled since January 2020, up 96.4% to $2,188 (assuming a 10% down payment), Zillow reported. Home values have risen 42.4% in that time, with the typical U.S. home now worth about $343,000. Mortgage rates ended January 2020 near 3.5%, keeping the cost of a home affordable for most households that could manage the down payment. At the time of this analysis, mortgage rates were about 6.6%.