Fannie Mae Finds Housing Sentiment at Highest Level in Nearly Two Years

(Illustration courtesy of Fannie Mae)

The Fannie Mae Home Purchase Sentiment Index increased 3.5 points in January to 70.7, its highest level since March 2022.

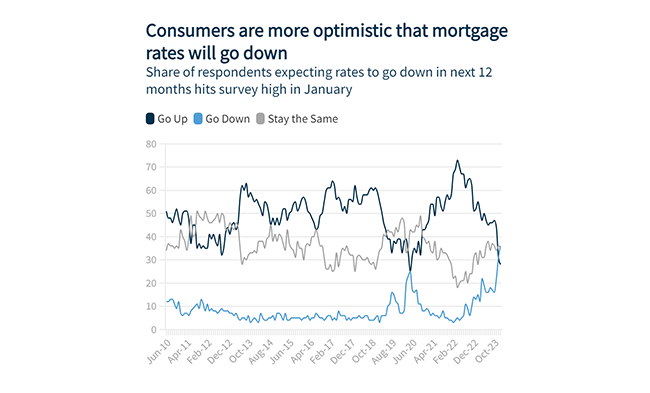

Fannie Mae credited the increase primarily to increased consumer confidence in job security and another significant jump in the share of consumers expecting mortgage rates to decrease.

In January, 82% of consumers indicated they are not concerned about losing their job in the next 12 months, up from 75% in December. Additionally, an all-time survey-high 36% of respondents indicated they expect mortgage rates to go down in the next 12 months, while 28% expect them to go up and 35% expect rates to remain the same.

But consumer perceptions of homebuying conditions remain overwhelmingly pessimistic, with only 17% of consumers indicating it’s a good time to buy a home. Overall, the full index is up 9.1 points year over year.

“Mortgage rate optimism increased markedly again in January, with a survey-high percentage of consumers anticipating mortgage rate declines over the next year,” said Fannie Mae Senior Vice President and Chief Economist Doug Duncan. “For the first time in our National Housing Survey’s history, a greater share of consumers believe mortgage rates will decrease over the next year, rather than increase.”

Duncan noted that while home affordability may improve if actual mortgage rates continue to move downward, other parts of the affordability equation have yet to ease or improve for consumers. “A large majority still think home prices will either increase or stay the same; the ‘good time to buy’ component continues to hover near its historical low; and fewer than one-in-five respondents indicated that their household income was significantly higher year over year, matching a survey low,” he said. “All in all, while a lower mortgage rate path supports our forecast for a gradual increase in housing demand and sales activity in 2024, until we see a meaningful increase in housing supply, we expect affordability will remain a significant barrier to homeownership for many households.”