Builder Sentiment Increases for Third Consecutive Month

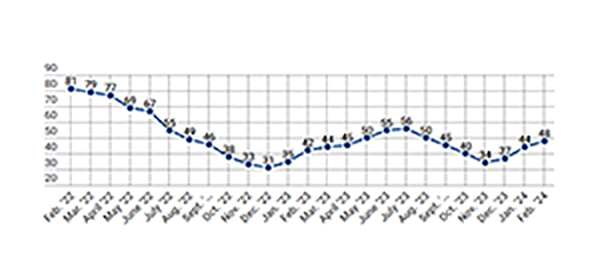

(Chart courtesy of NAHB)

Expectations that mortgage rates will continue to moderate, the prospect of future rate cuts and a protracted lack of existing inventory boosted home builder sentiment for the third straight month.

Builder confidence in the market for newly built single-family homes climbed four points to 48 in February, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index. This is the highest level since August 2023.

“Buyer traffic is improving as even small declines in interest rates will produce a disproportionate positive response among likely home purchasers,” NAHB Chairman Alicia Huey said. “And while mortgage rates still remain too high for many prospective buyers, we anticipate that due to pent-up demand, many more buyers will enter the marketplace if mortgage rates continue to decline this year.”

CoreLogic Chief Economist Selma Hepp said homebuilder sentiment is being boosted by the decline in mortgage rates and gradual improvements in housing fundamentals overall. “Improvement in housing affordability resulting from lower rates is helping drive entry-level demand once again,” she noted. “Taken together, stronger homebuilder activity of single-family homes should mean more available inventory for potential buyers and less pressure on home prices than in the heat of the pandemic.”

But NAHB Chief Economist Robert Dietz observed that the recovery could be bumpy, noting the 10-year Treasury rate is up more than 40 basis points since the beginning of the year.

In February, 25% of builders reported cutting home prices, down from 31% in January and 36% in the last two months of 2023, the report said. Meanwhile, the use of sales incentives is also diminishing. The share of builders offering some form of incentive dropped to 58% in February, down from 62% in January and the lowest share since last August.