Asking Rents Fall; Renters Can Afford Larger Spaces, Redfin Finds

(Image courtesy of Redfin; Breakout image courtesy of Blue Arauz/pexels.com)

Redfin, Seattle, released two analyses of the current rental market, including the finding that the median asking rent fell 0.7% year-over-year in November to $1,595.

That’s also a 1.1% drop from October.

The asking price per square foot fell 2.2% year-over-year, to the lowest level since December 2021, and rents fell across all bedroom counts for the fifth straight month.

Looking at prices overall, the median rent is now 6.2% lower than its all-time high of $1,700 in August 2022.

The lower prices come as apartment completions continue to go online. Nationally, completions were up 22.6% year-over-year to the highest level in more than a decade. The vacancy rate for buildings with five or more units rose to 8% in Q3, the highest level since early 2021.

“Renters in areas where construction has boomed are in a sweet spot right now. Affordability is improving as rents fall and wages rise, and there is increased choice with more and more new apartment buildings opening,” said Redfin Senior Economist Sheharyar Bokhari. “As construction starts to slow, rents will eventually tick back up, but 2025 is shaping up as a renter’s market with potential for the affordability gap between buying and renting to widen.”

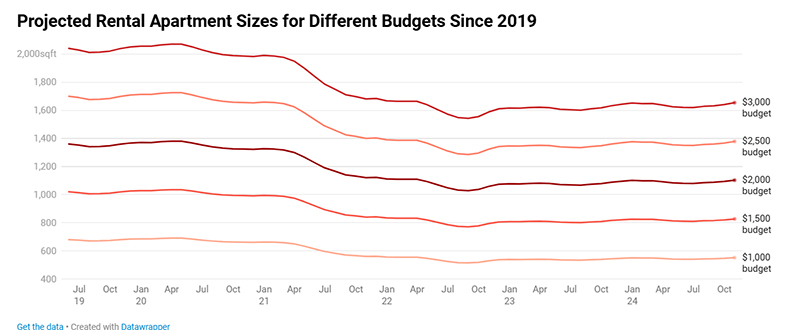

Continuing good news for renters, Redfin also reported a renter on a $2,000 budget can currently afford more square footage than they could during the COVID-19 pandemic.

In August 2022, when rents peaked, $2,000 a month garnered a 1,029-square-foot unit. Now it commands 1,103 square feet.

However, in October 2019, before the pandemic housing boom, a renter with a $2,000 budget would have averaged a 1,359-square-foot apartment.

“Renters are getting more bang for their buck than they were during the pandemic because asking rents have since stabilized below their record high and incomes have continued to climb,” said Bokhari. “Rental affordability has improved thanks to the recent apartment construction boom, especially in Sun Belt states. That trend is likely to continue into 2025, as there are a lot of still-to-be-finished apartment buildings due to come online.”