FHFA Finalizes 2025–2027 Housing Goals for Fannie Mae, Freddie Mac

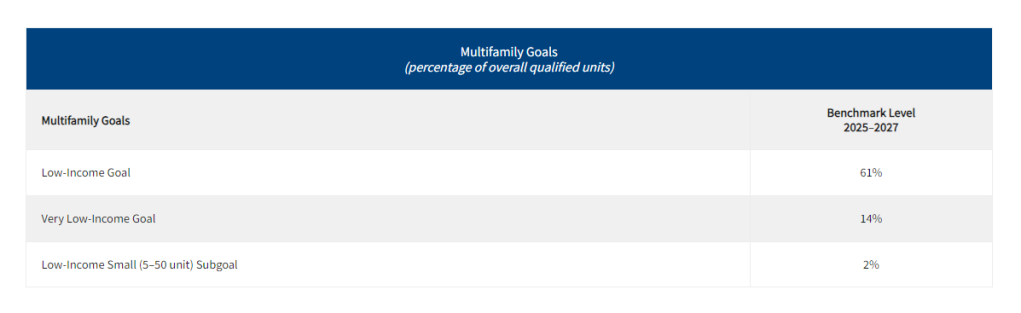

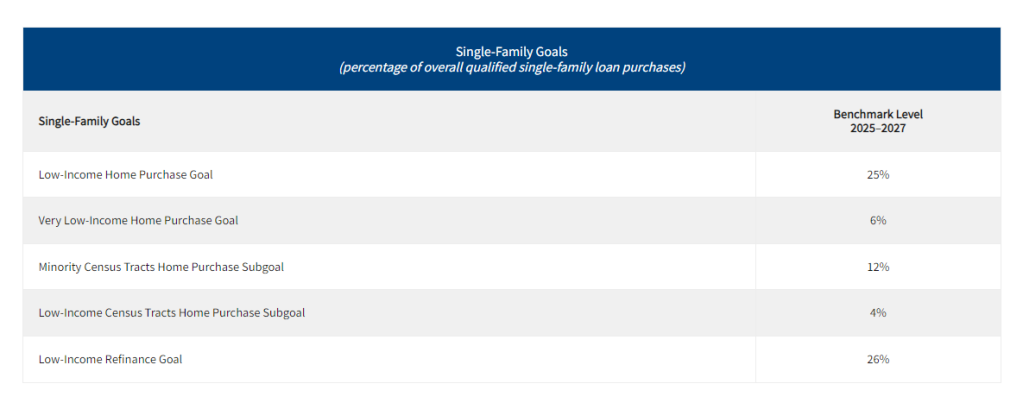

(Charts courtesy of FHFA)

The Federal Housing Finance Agency, Washington, D.C. issued a final rule last year establishing new affordable housing goals for the loan purchases of Fannie Mae and Freddie Mac over the next three years.

FHFA also updated the process for requiring an action plan if an enterprise misses certain goals.

FHFA Director Sandra L. Thompson said the affordable housing goals better enable the enterprises to support housing finance markets. “It is critical that the Enterprises meet these goals, as required by law and regulation,” she said.

For single-family housing goals, the enterprises must meet the benchmark level or the actual market level of loans for each category outlined in the following table. (The actual market level is determined retrospectively for the year based on Home Mortgage Disclosure Act data.)

The final rule also establishes new “measurement buffers” to help determine if an enterprise that misses certain single-family housing goals during the 2025–2027 cycle must develop an action plan to demonstrate how it will improve its performance.

For multifamily properties, the enterprises must meet the benchmark levels outlined in the table below. For the low-income and very low-income goals, an Enterprise’s benchmark is the percentage of units — in multifamily properties with loans acquired by that Enterprise — that are affordable to tenants in the respective income categories. A separate subgoal measures the proportion of units in small (5–50 units) multifamily properties that are affordable to low-income families.