MCT Finds 5.67% Decrease in Mortgage Lock Volume in July

(Image courtesy of MCT; Breakout image courtesy of Harrison Haines/pexels.com)

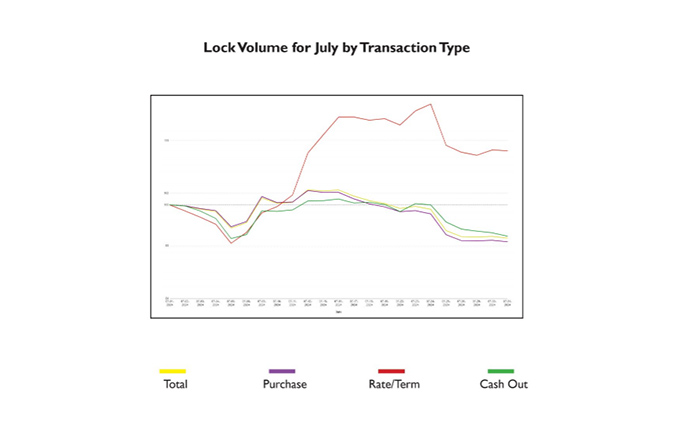

Mortgage Capital Trading, San Diego, announced a decrease of 5.67% in mortgage lock volume from June to July.

Broken down by type, MCT reported a 6.31% month-over-month drop in the purchase index and a 5.37% drop in the cash-out refinance index.

However, MCT also reported a 9.26% increase in the rate/term refinance index from June to July.

Overall, mortgage lock volume has continued to trend downward over the past eight weeks, MCT reported.

That trend is expected to continue into the next month, and MCT posited that potential buyers may be holding off in anticipation of a September rate cut or other factors.

“[The recent] nonfarm payroll report came in below expectations along with a higher than expected unemployment rate. If this trend continues, it is looking very likely the Federal Reserve will cut rates in their September meetings,” Andrew Rhodes, Senior Director, Head of Trading at MCT, stated.

MCT’s Rate Lock Indices present a snapshot of rate lock volume activity in the residential mortgage business across a broad range of lenders. The August Indices Report covered July 1 to July 31.