Arbor: Small Multifamily Subsector Remains on Solid Footing

(Image courtesy of Arbor; Breakout image courtesy of Image courtesy of Andrea De Santis/pexels.com)

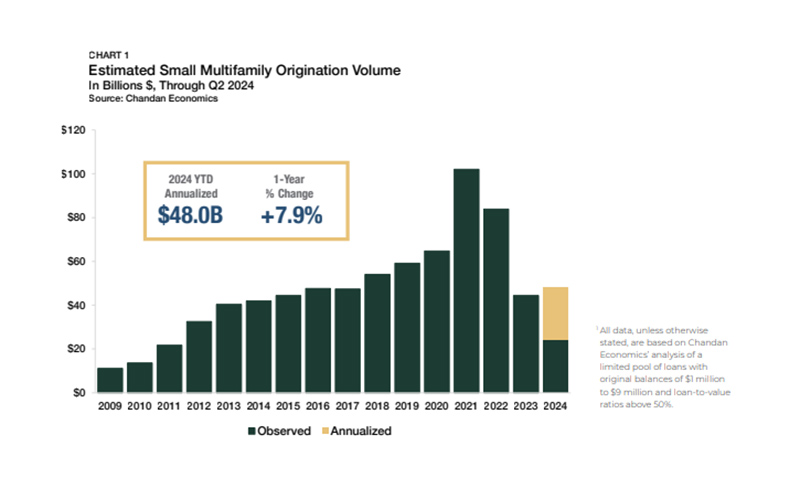

Arbor, Uniondale, N.Y., released its Small Multifamily Investment Trends Report for Q3, finding that small multifamily originations are on pace for a 7.9% increase in 2024.

Small multifamily originations are currently on an annualized pace to reach $48 billion by year-end, up from 2023’s $44.4 billion, but still a far cry from 2022’s $83.9 billion.

The refinancing share of originations has begun to normalize, and was at 68.9% in Q2.

Distress remains limited within the sector, Arbor reported. Additionally, multifamily completions are at a five-year high and rents were up year-over-year through June

Among other results, the Arbor Small Multifamily Price Index showed that asset valuations were down 1.5% year-over-year, and down 11.2% from their 2022 peak, largely driven by rising cap rates.

Cap rates reversed a first-quarter decline, rising to 6.1%. That marks the first time cap rates have been above 6% since 2018.

“Rising cap rates have been a double-edged sword for small multifamily,” the report noted. “On the one hand, cap rate increases have negatively impacted asset valuations. At the same time, they have improved the return profile for prospective investors.”

Expense ratios have remained stable in recent quarters–in Q2, expense ratios in small multifamily properties receiving financing averaged 40.4%, down slightly from 40.6% the previous quarter.

Occupancy rates within small multifamily properties receiving financing averaged 97.1%, an improvement from the past two quarters and fairly flat with a year ago.

Small multifamily loan-to-value ratios remained below pre-pandemic levels and were down 9.1 percentage points from a peak of 68.9% in 2019.

Average debt yields for small multifamily loans continued to grow, reaching 9.9%.

Overall, debt yields have increased more substantially than cap rates, with the spread between debt yields and cap rates at 383 basis points. That’s the widest spread since 2013, Arbor noted.